########################################################################################

############## Forecasting: SARIMA models ############################

########################################################################################

library(MLTools)

library(fpp2)

library(readxl)

library(tidyverse)

library(TSstudio)

library(lmtest) #contains coeftest function

library(tseries) #contains adf.test function2025_09_24 SARIMA, lecture notes

Preliminaries

Set working directory

setwd(dirname(rstudioapi::getActiveDocumentContext()$path))Car Registration Example

Load dataset

fdata <- read_excel("CarRegistrations.xls")Visualize the first rows:

head(fdata)# A tibble: 6 × 2

Fecha CarReg

<dttm> <dbl>

1 1960-01-01 00:00:00 3.36

2 1960-02-01 00:00:00 4.38

3 1960-03-01 00:00:00 4.06

4 1960-04-01 00:00:00 5.38

5 1960-05-01 00:00:00 6.31

6 1960-06-01 00:00:00 4.02Convert character columns to R date type

fdata$Fecha <- as.Date(fdata$Fecha, format = "%d/%m/%Y")

head(fdata)# A tibble: 6 × 2

Fecha CarReg

<date> <dbl>

1 1960-01-01 3.36

2 1960-02-01 4.38

3 1960-03-01 4.06

4 1960-04-01 5.38

5 1960-05-01 6.31

6 1960-06-01 4.02Order the table by date (using the pipe operator)

fdata <- fdata %>% arrange(Fecha)This is the same as: fdata <- arrange(fdata, Fecha)

Check for missing dates (time gaps)

range(fdata$Fecha)[1] "1960-01-01" "1999-12-01"Create a complete sequence of months with the same range and compare it to the dates in our data.

date_range <- seq.Date(min(fdata$Fecha), max(fdata$Fecha), by = "months")

date_range[!date_range %in% fdata$Fecha]Date of length 0We also check for duplicates

fdata %>%

select(Fecha) %>%

duplicated() %>%

which()integer(0)Check for missing data (NA) in time series value columns

sum(is.na(fdata$CarReg))[1] 0Convert it to a time series object

This is monthly data, so the frequency is 12. The series start in January. If it starts in e.g. April we would use start = c(1960, 4)

freq <- 12

start_date <- c(1960, 1)

y <- ts(fdata$CarReg, start = start_date, frequency = freq)Time plot:

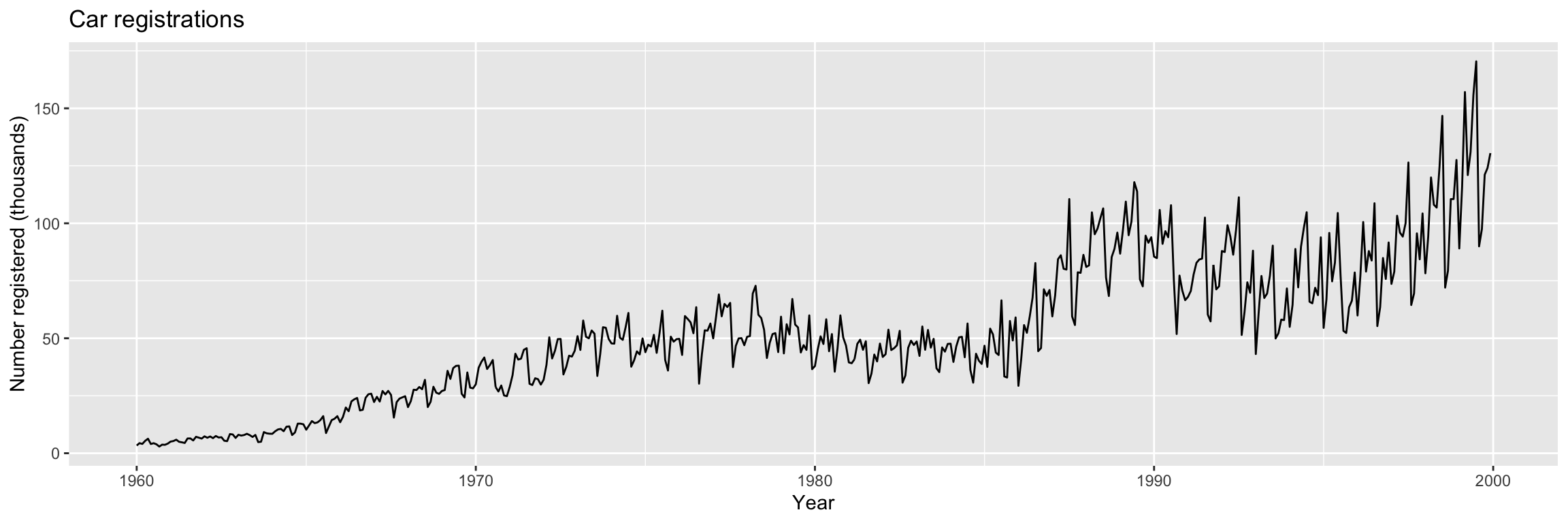

autoplot(y) +

ggtitle("Car registrations") +

xlab("Year") + ylab("Number registered (thousands)")

Train/test split

The train/test split method in forecasting needs to take the temporal structure into account, as illustrated in this picture (from Section 3.4 of Hyndman & Athanasopoulos (2018))

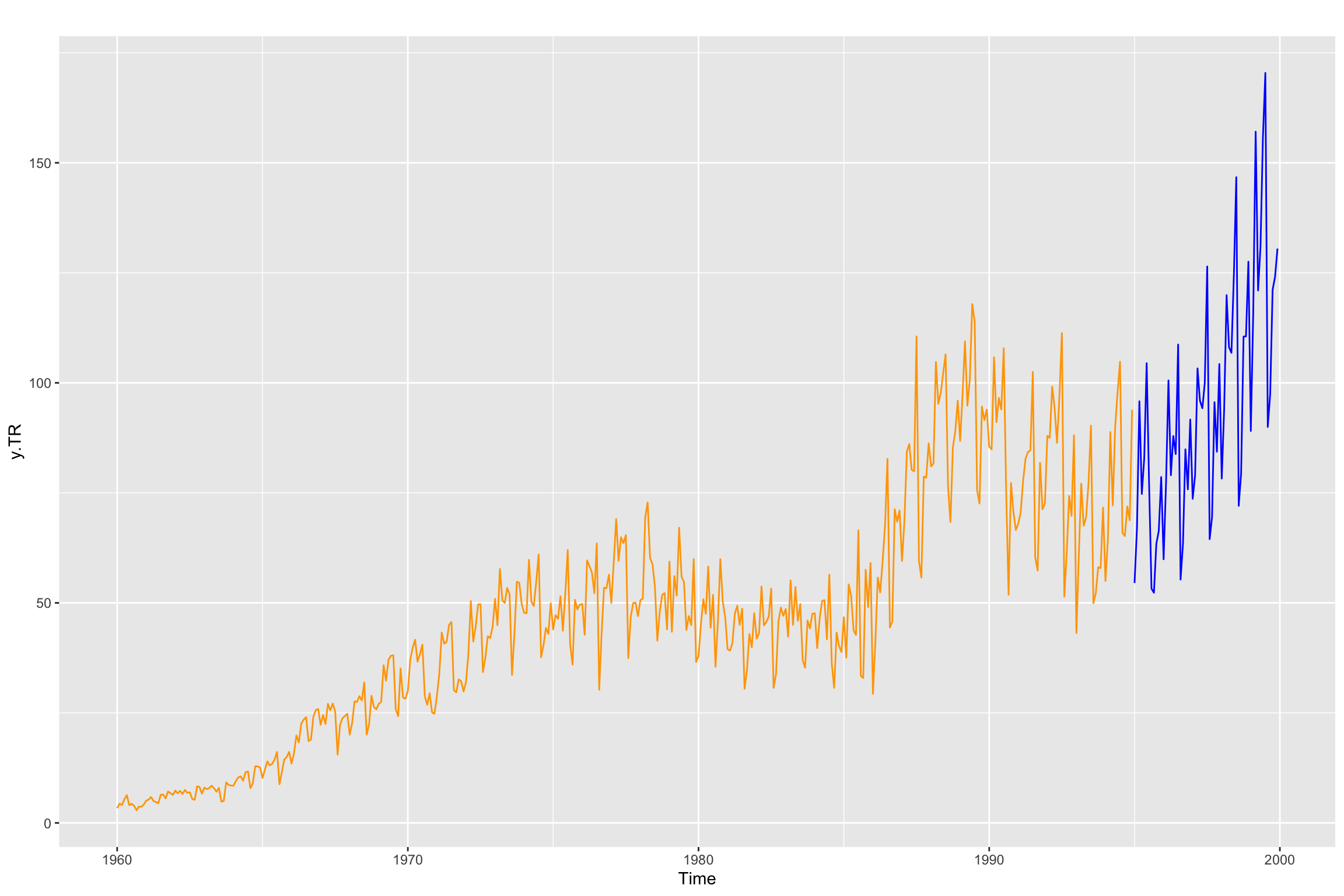

n <- length(y)We will leave the last 5 years for validation

n_test <- floor(5 * freq)

y_split <- ts_split(y, sample.out = n_test)

y.TR <- y_split$train

y.TV <- y_split$testAlternatively, with subset

# Line 39 of Lab4

y.TR <- subset(y, end = length(y) - 5 * 12)

y.TV <- subset(y, start = length(y) - 5 * 12 + 1)Or even with head and tail:

y.TR <- head(y, length(y) - 5 * 12)

y.TV <- tail(y, 5 * 12) In fact it is usually a good idea to check the split using head and tail to see the last elements of training and the first ones of test:

tail(y.TR) Jul Aug Sep Oct Nov Dec

1994 104.812 65.899 65.201 71.931 68.761 93.883head(y.TV) Jan Feb Mar Apr May Jun

1995 54.513 66.954 95.812 74.758 82.887 104.472And let us also visualize the split.

autoplot(y.TR, color = "orange") +

autolayer(y.TV, color = "blue")

What if I don’t know the sampling rate of the time series?

Donwload the following data file: fdata2.dat

Let us use plots to explore the series

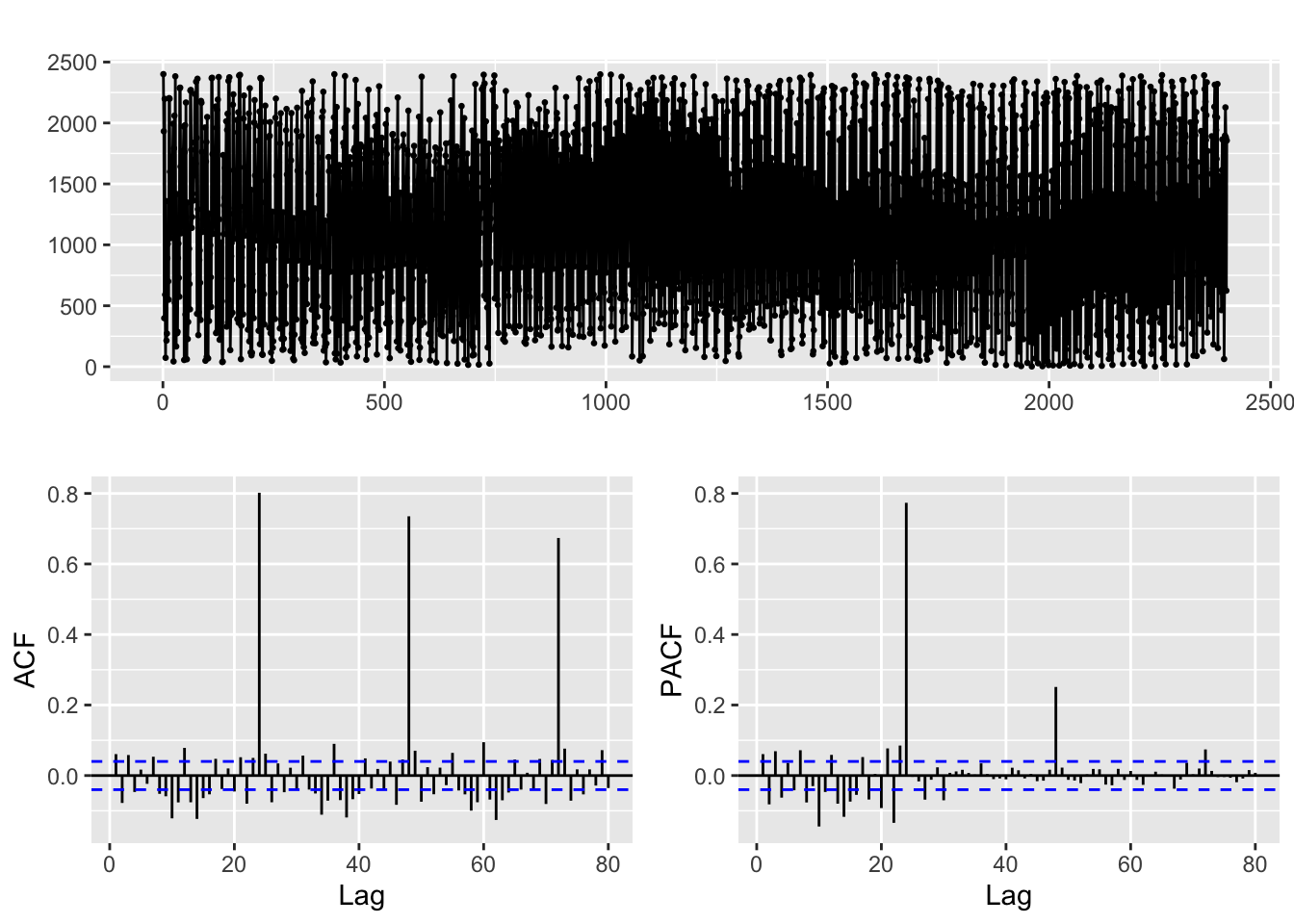

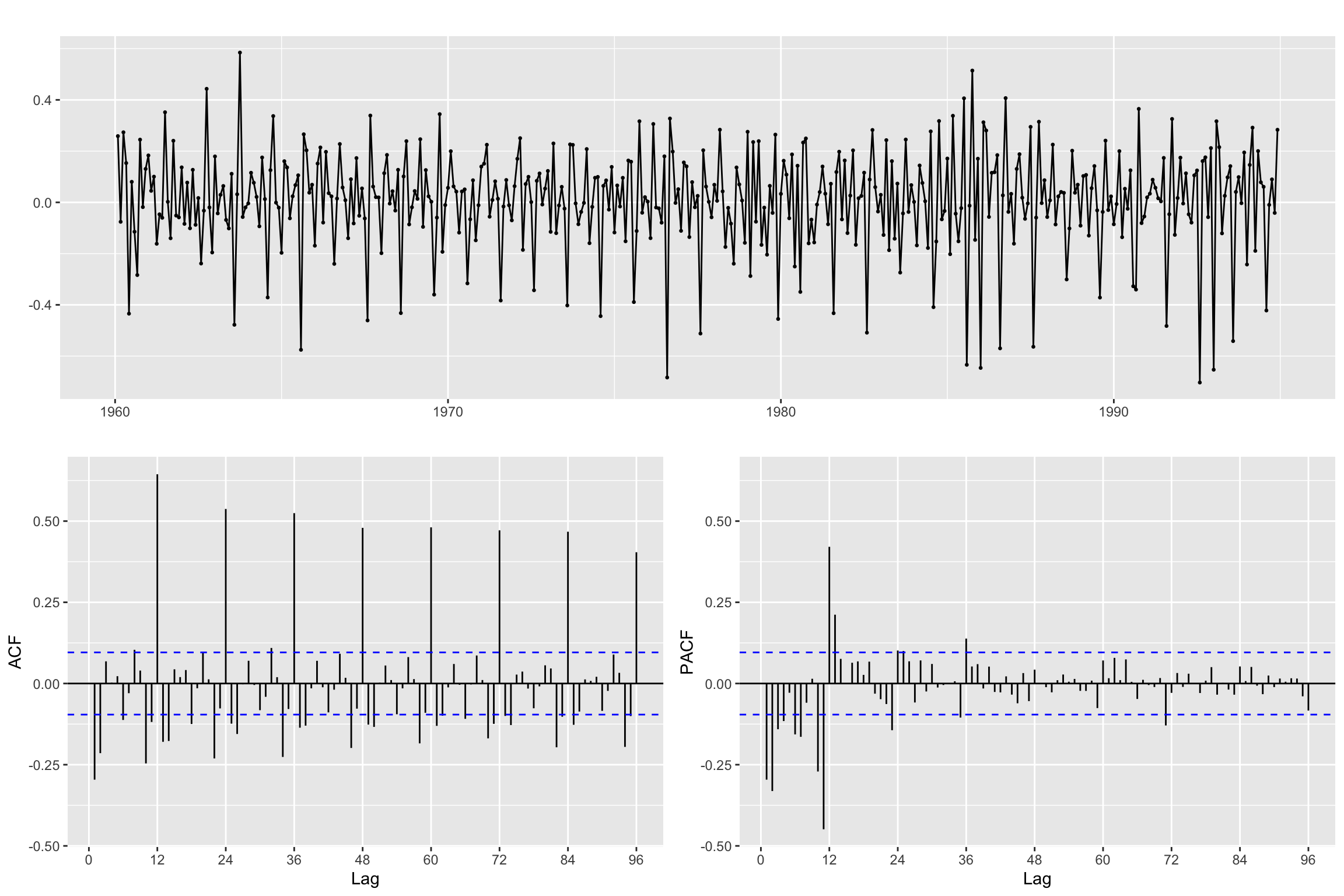

fdata2 <- ts(read.table("fdata2.dat", sep = ""))

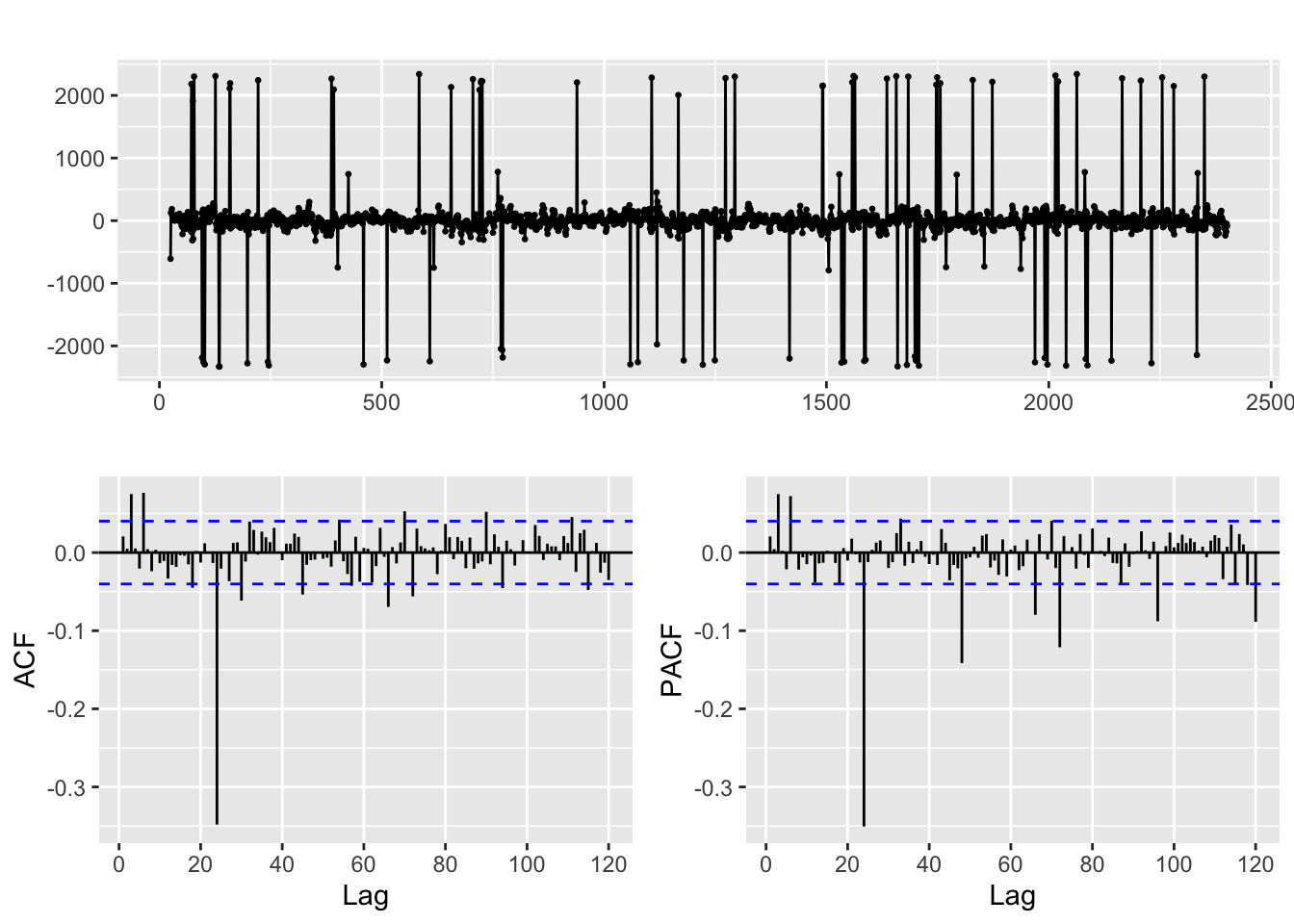

ggtsdisplay(fdata2, lag.max = 80)

The time plot does not clearly show the frequency (in cases like this you should try zooming in, though!). But the ACF is more telling, it shows significant correlations at what seems to be lags = 24, 48, 96, … (so the sampling rate of this data seems to be … daily, weekly, … ?)

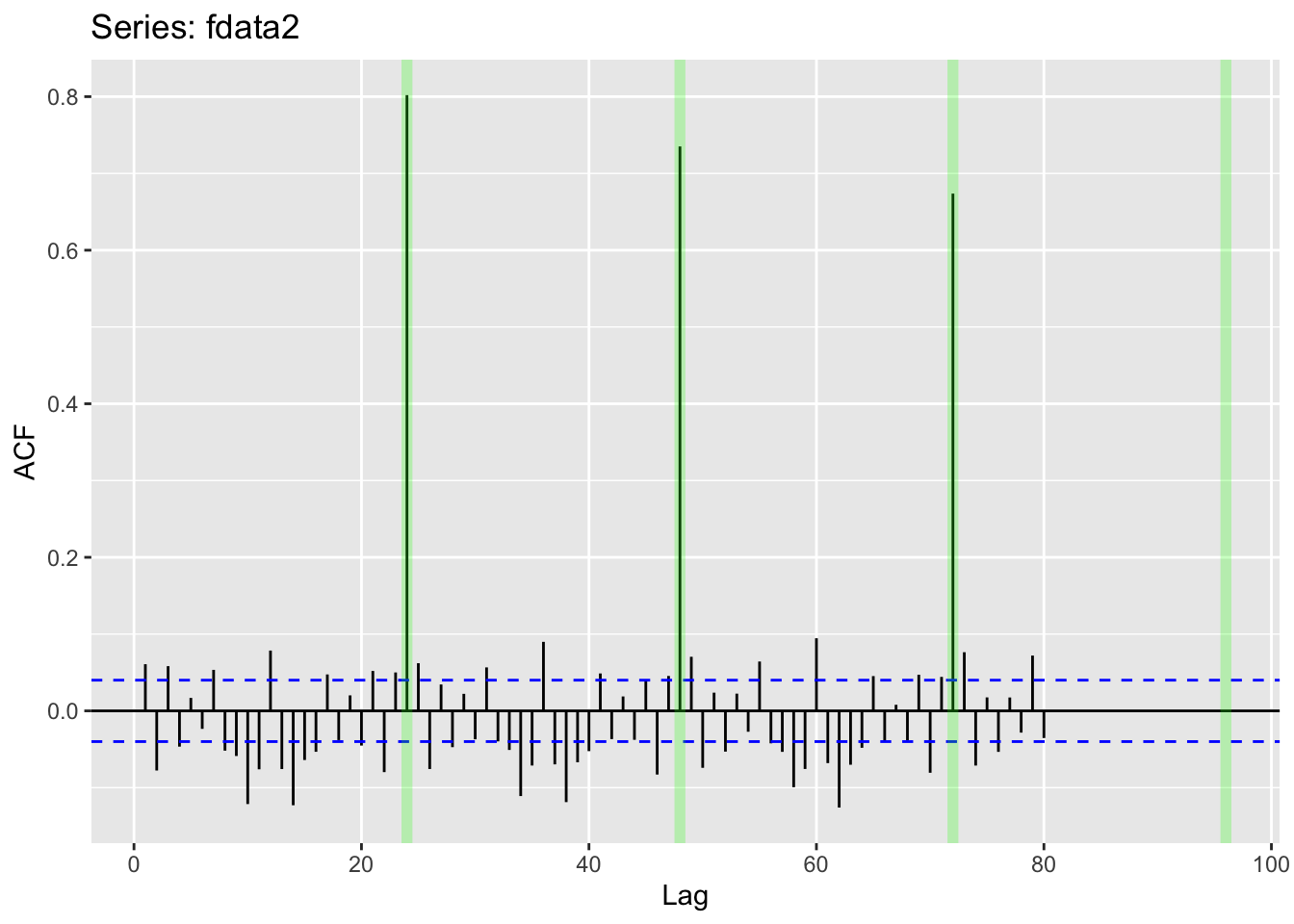

Let us try that and emphasize the lags we suspect to be relevant:

freq <- 24

ggAcf(fdata2, lag.max = 80)+

geom_vline(xintercept = (1:4) * freq, color = "green", alpha = 0.25, size=2)Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

ℹ Please use `linewidth` instead.

Applying a seasonal difference

ggtsdisplay(diff(fdata2, lag = freq), lag.max = 5 * freq)

Identification and fitting process

Let us return to the Car Registration example

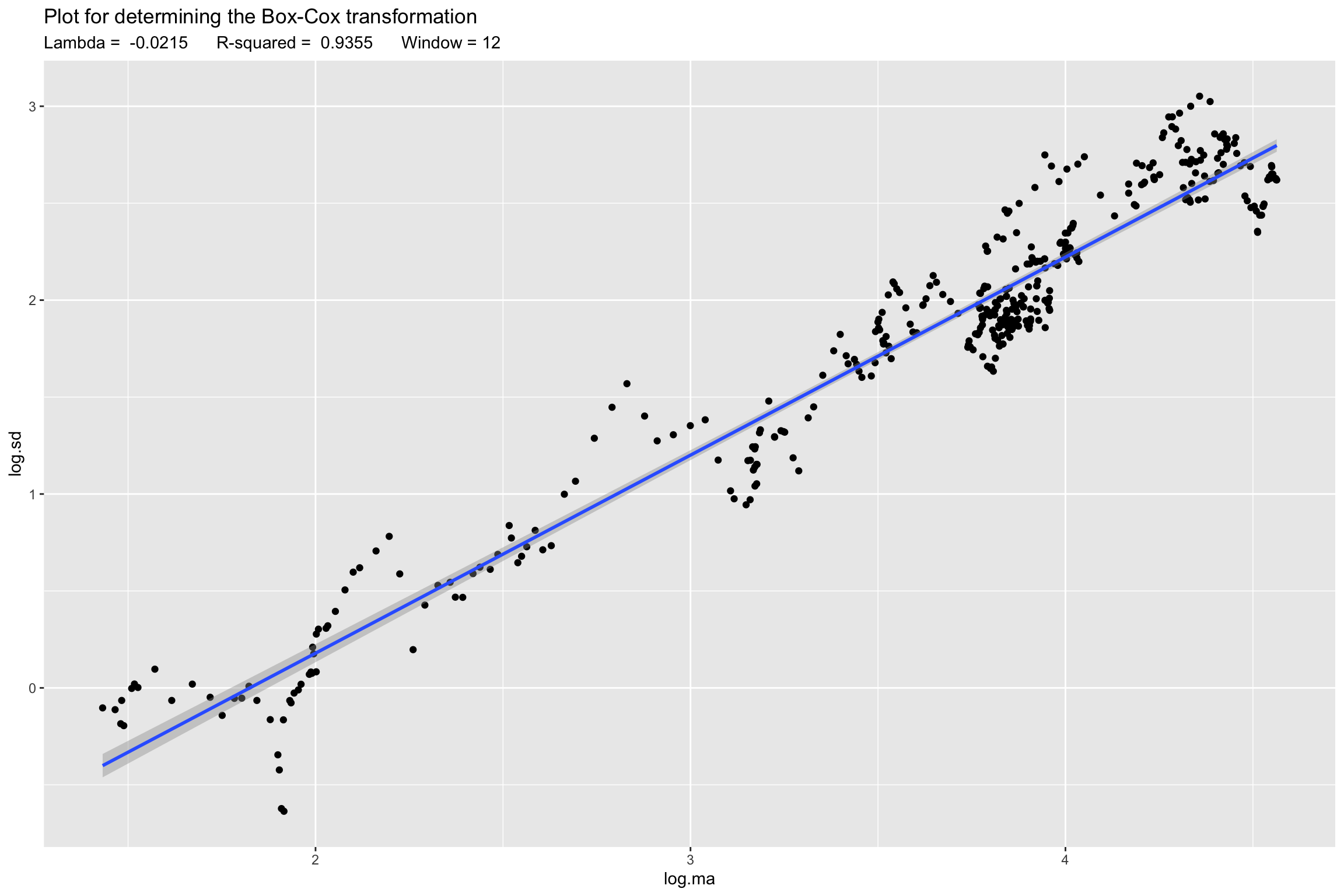

Box-Cox transformation

# Line 48 of Lab4

Lambda <- BoxCox.lambda.plot(y.TR, window.width = 12)`geom_smooth()` using formula = 'y ~ x'

# Line 51 of Lab4

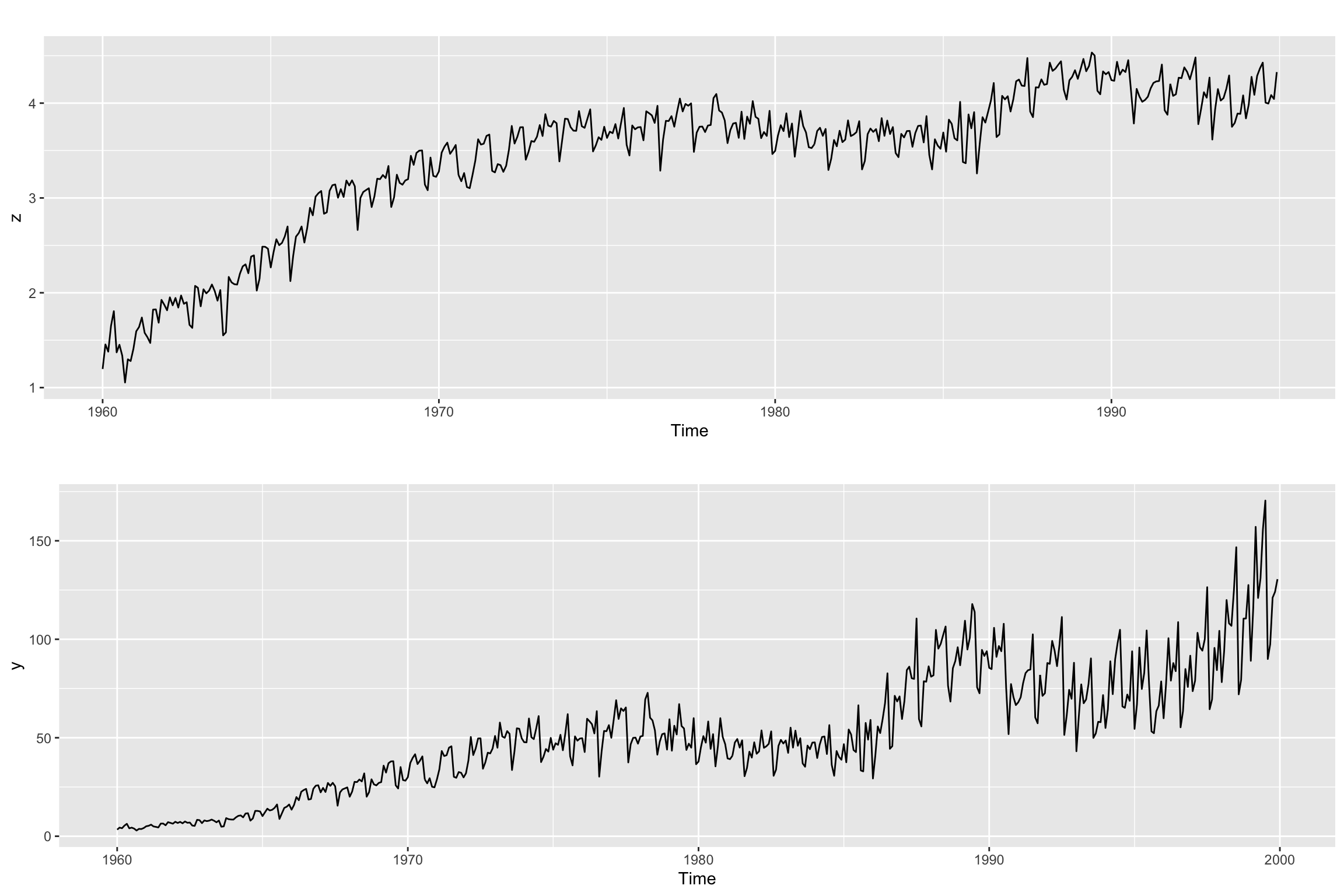

z <- BoxCox(y.TR, Lambda)# Line 39 of Lab4

p1 <- autoplot(z)

p2 <- autoplot(y)

gridExtra::grid.arrange(p1, p2, nrow = 2 )

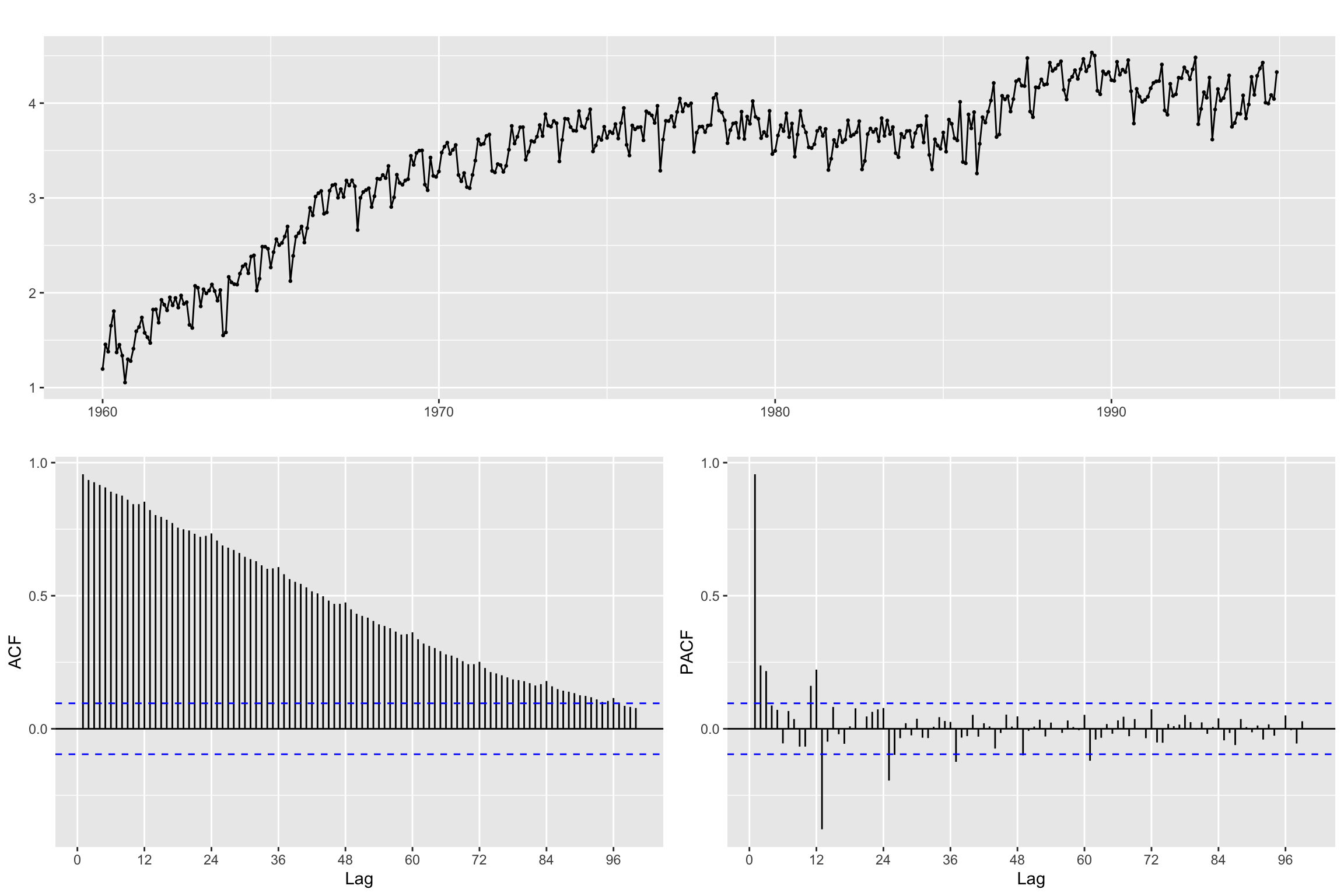

Differencing

# Line 58 of Lab4

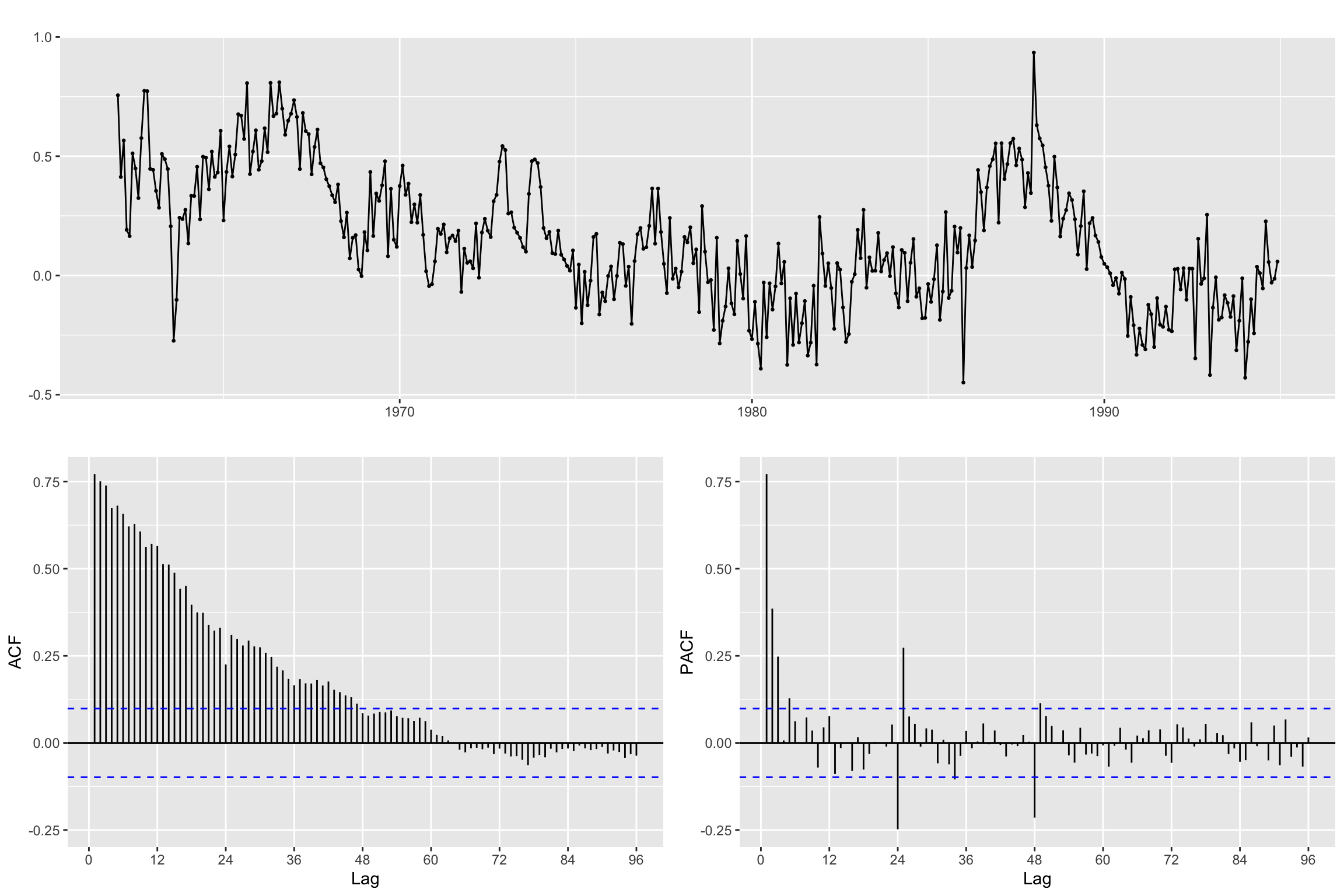

#recall if the ACF decreases very slowly -> needs differentiationggtsdisplay(z,lag.max = 100)

Seasonal Differencing

It is generally better to start with seasonal differencing when a time series exhibits both seasonal and non-seasonal patterns.

# Line 62 of Lab4

B12z<- diff(z, lag = freq, differences = 1)We use the ACF and PACF to inspect the result

ggtsdisplay(B12z,lag.max = 4 * freq)

Regular Differencing (without seasonal)

# Line 66 of Lab4

Bz <- diff(z,differences = 1)ggtsdisplay(Bz, lag.max = 4 * freq)

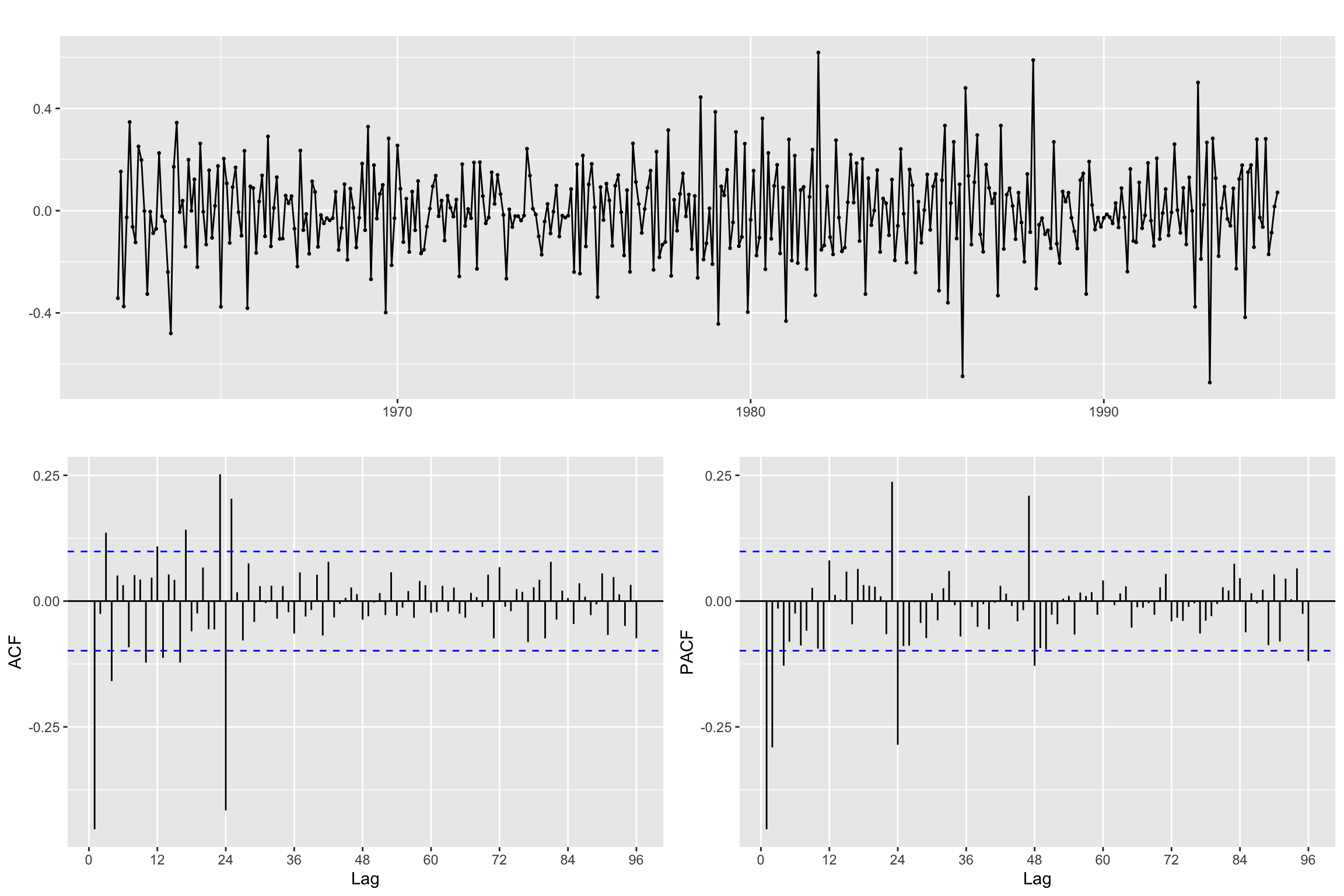

Both regular & seasonal Differentiation

# Line 70 of Lab4

B12Bz <- diff(Bz, lag = freq, differences = 1)ggtsdisplay(B12Bz, lag.max = 4 * freq)

Remember, when you apply both differences the order does not matter. Here we check that visually:

B_B12z<- diff(B12z, differences = 1)# Line 75 of Lab4

autoplot(B12Bz, color = "blue", size = 2) + autolayer(B_B12z, color = "orange", size = 0.5)

Model Order (p, d, q)(P, D, Q)_s selection

Now, using the results above, we select both the regular d and the seasonal D orders of differencing and the ARMA structure, both regular and seasonal

p <- 0

d <- 1

q <- 1

P <- 1

D <- 1

Q <- 1Fit seasonal model with estimated order

# Line 80 (modified) of Lab4

arima.fit <- Arima(y.TR,

order=c(p, d, q),

seasonal = list(order=c(P, D, Q), period=freq),

lambda = Lambda,

include.constant = FALSE)Model Diagnosis

Summary of training errors and estimated coefficients

# Line 86 of Lab4

summary(arima.fit)Series: y.TR

ARIMA(0,1,1)(1,1,1)[24]

Box Cox transformation: lambda= -0.02149828

Coefficients:

ma1 sar1 sma1

-0.5997 0.0877 -0.8988

s.e. 0.0432 0.0670 0.0655

sigma^2 = 0.01475: log likelihood = 255.92

AIC=-503.83 AICc=-503.73 BIC=-487.92

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.432281 6.160028 4.327191 -2.242973 9.844774 0.6289316

ACF1

Training set -0.03946431Statistical significance of estimated coefficients

# Line 87 of Lab4

coeftest(arima.fit)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ma1 -0.599729 0.043169 -13.8927 <2e-16 ***

sar1 0.087686 0.066970 1.3093 0.1904

sma1 -0.898751 0.065466 -13.7285 <2e-16 ***

---

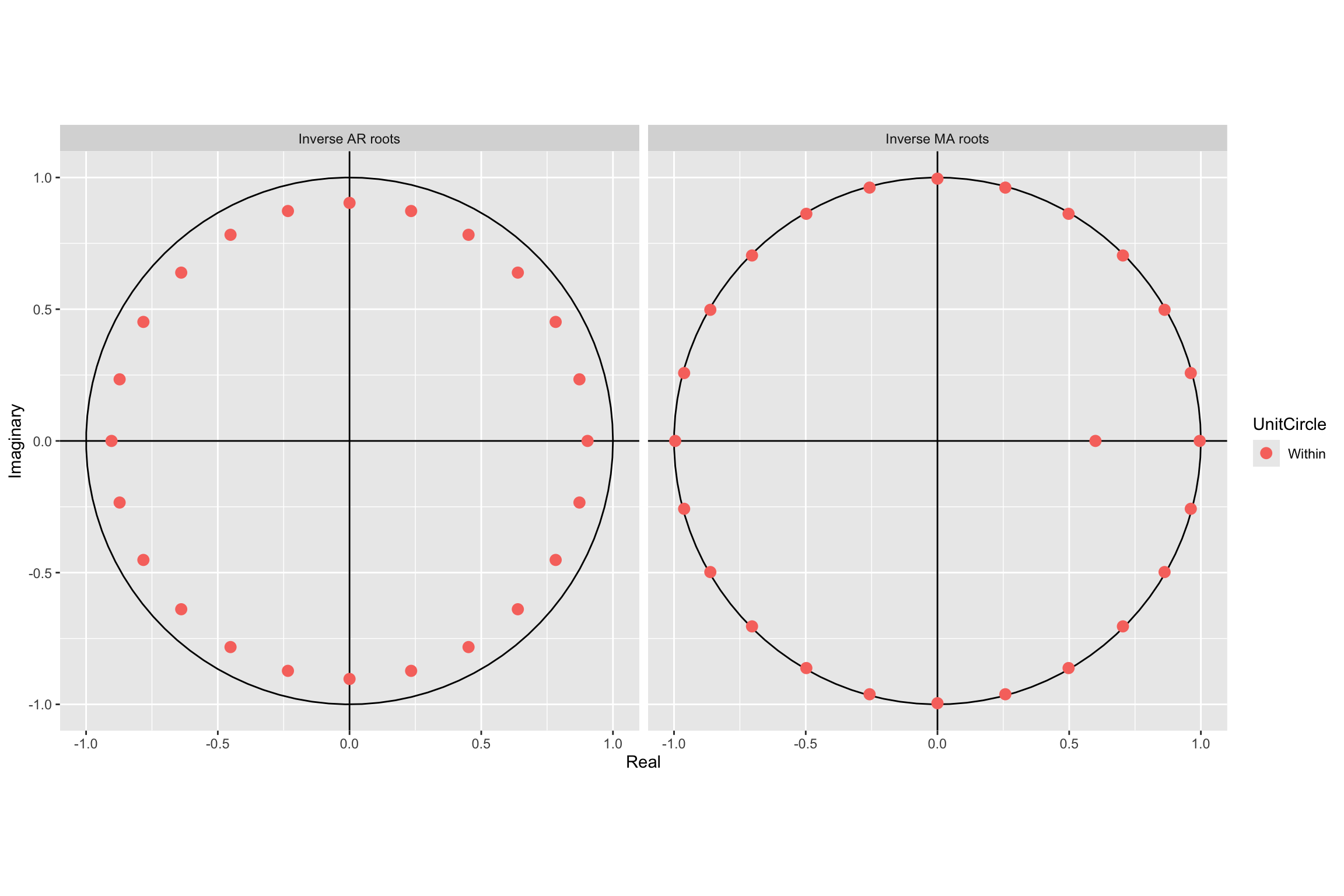

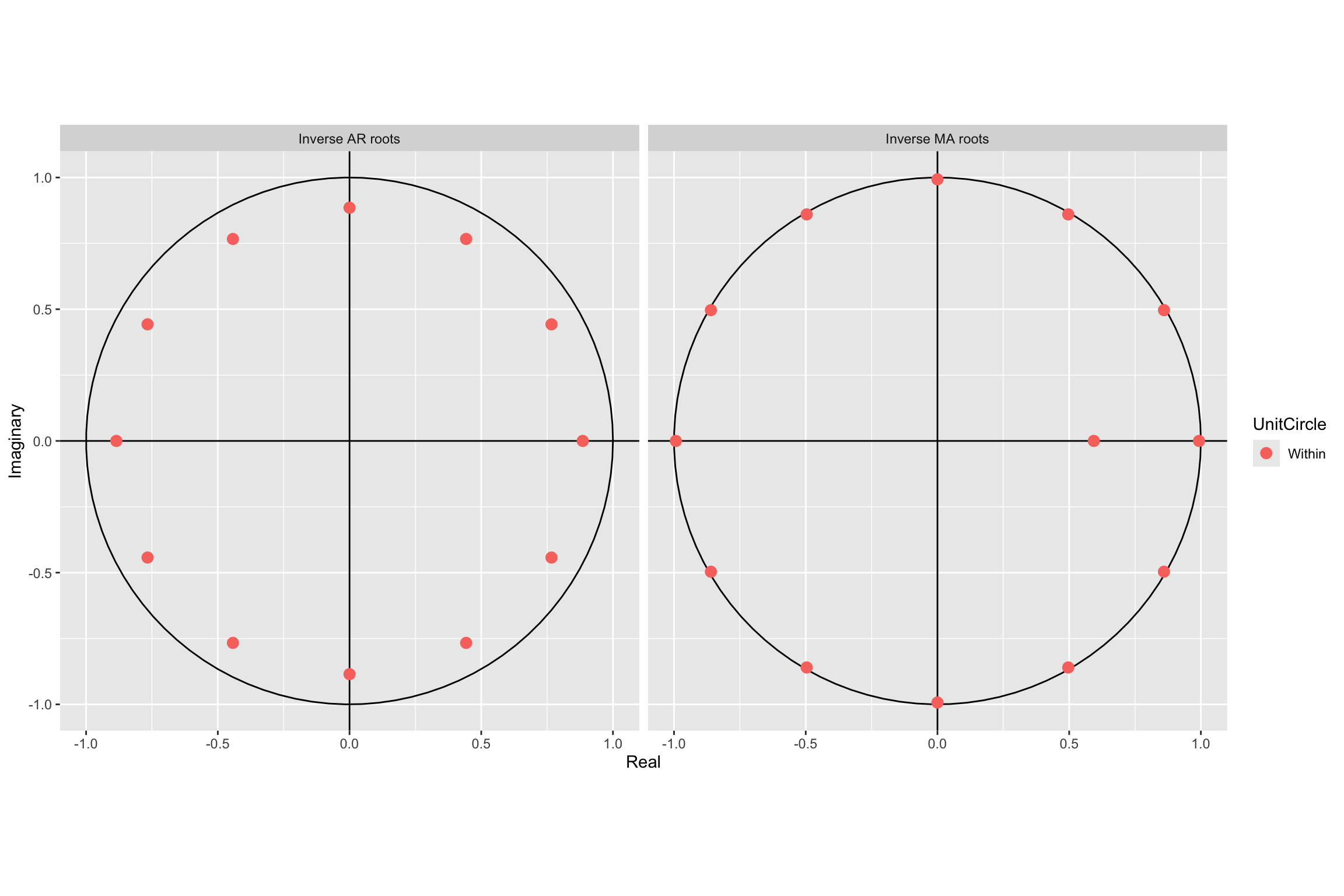

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Root plot

# Line 88 of Lab4

autoplot(arima.fit)

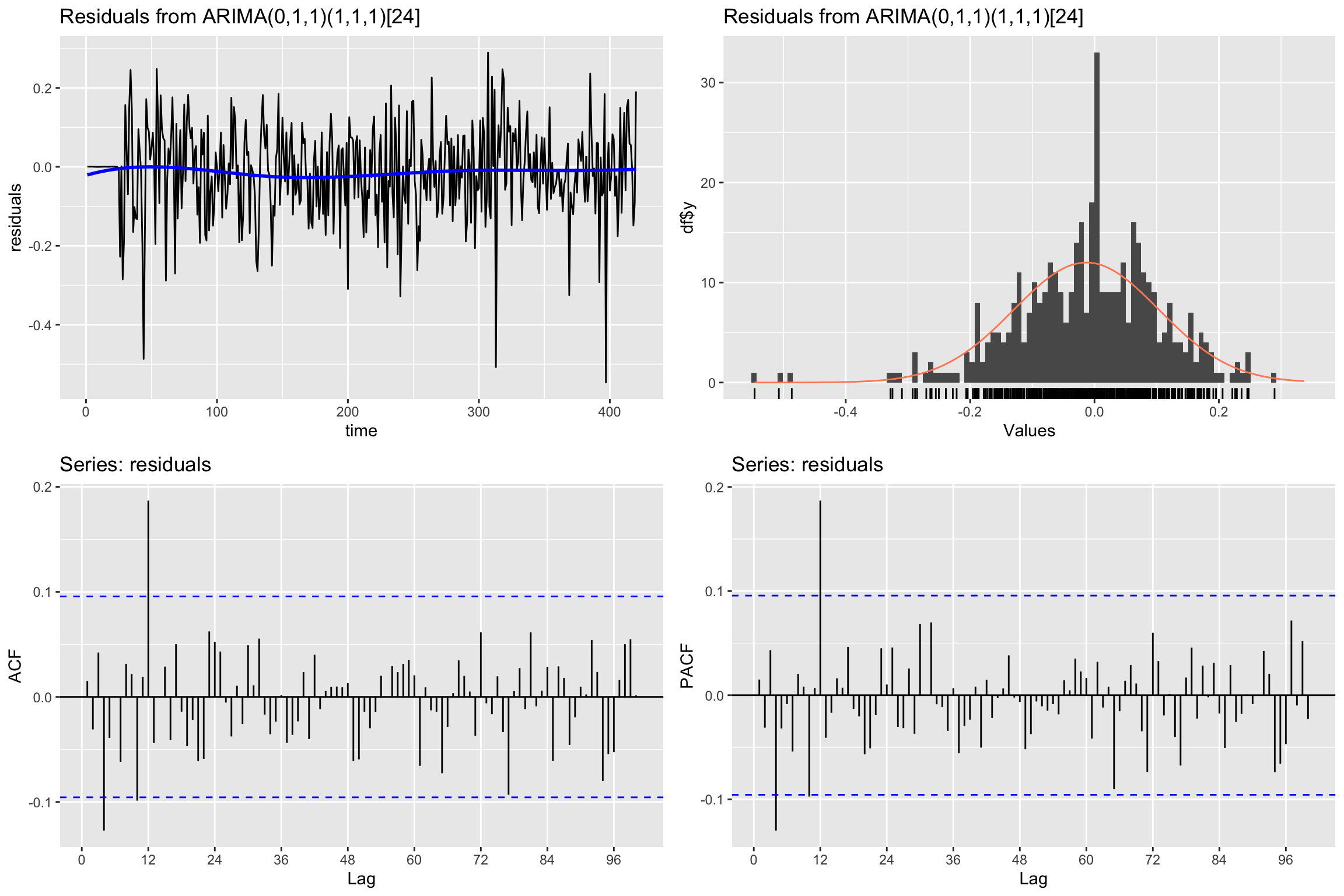

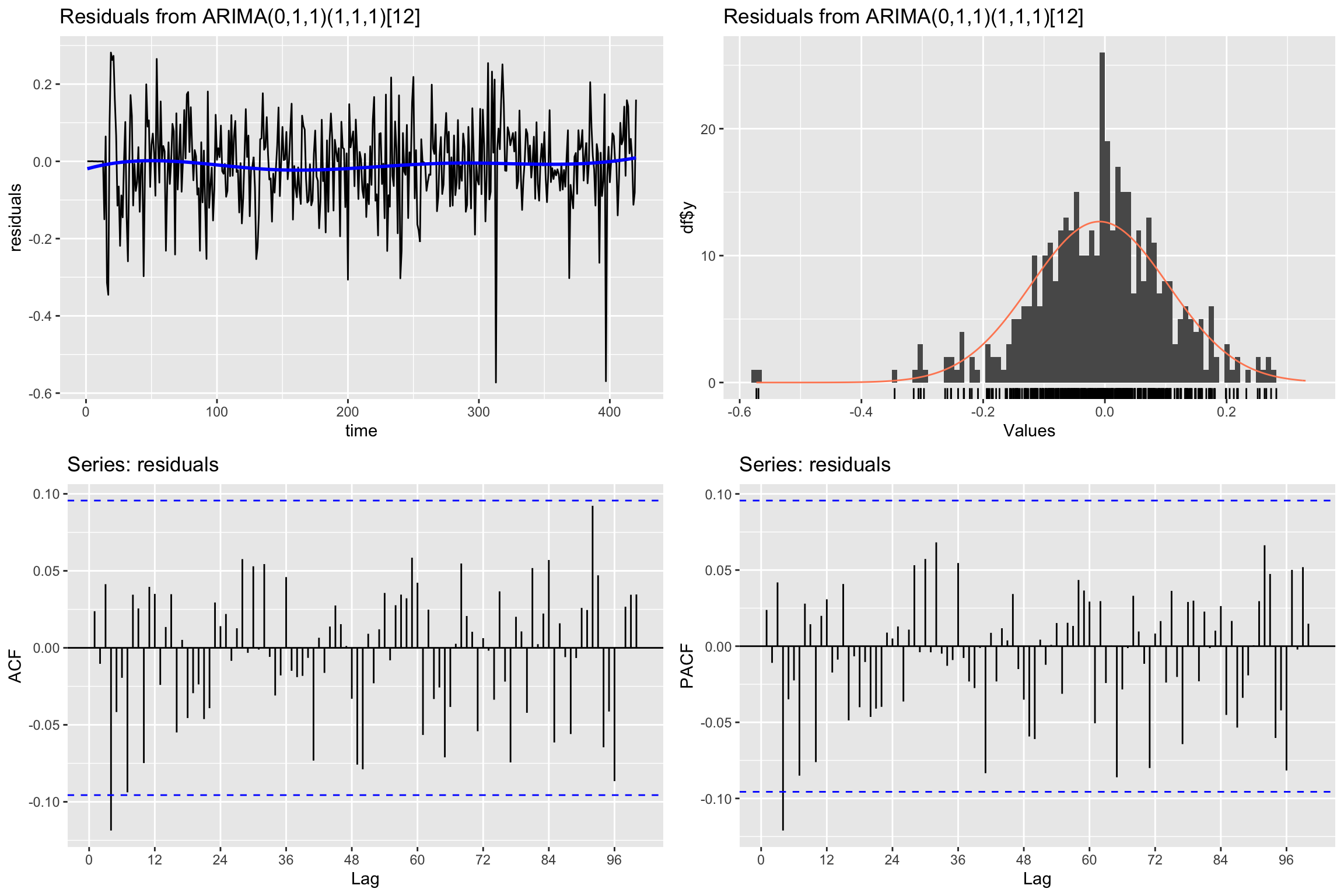

Check residuals

# Line 91 of Lab4

CheckResiduals.ICAI(arima.fit, bins = 100, lag=100)

Ljung-Box test

data: Residuals from ARIMA(0,1,1)(1,1,1)[24]

Q* = 89.452, df = 97, p-value = 0.6944

Model df: 3. Total lags used: 100If residuals are not white noise, change order of ARMA

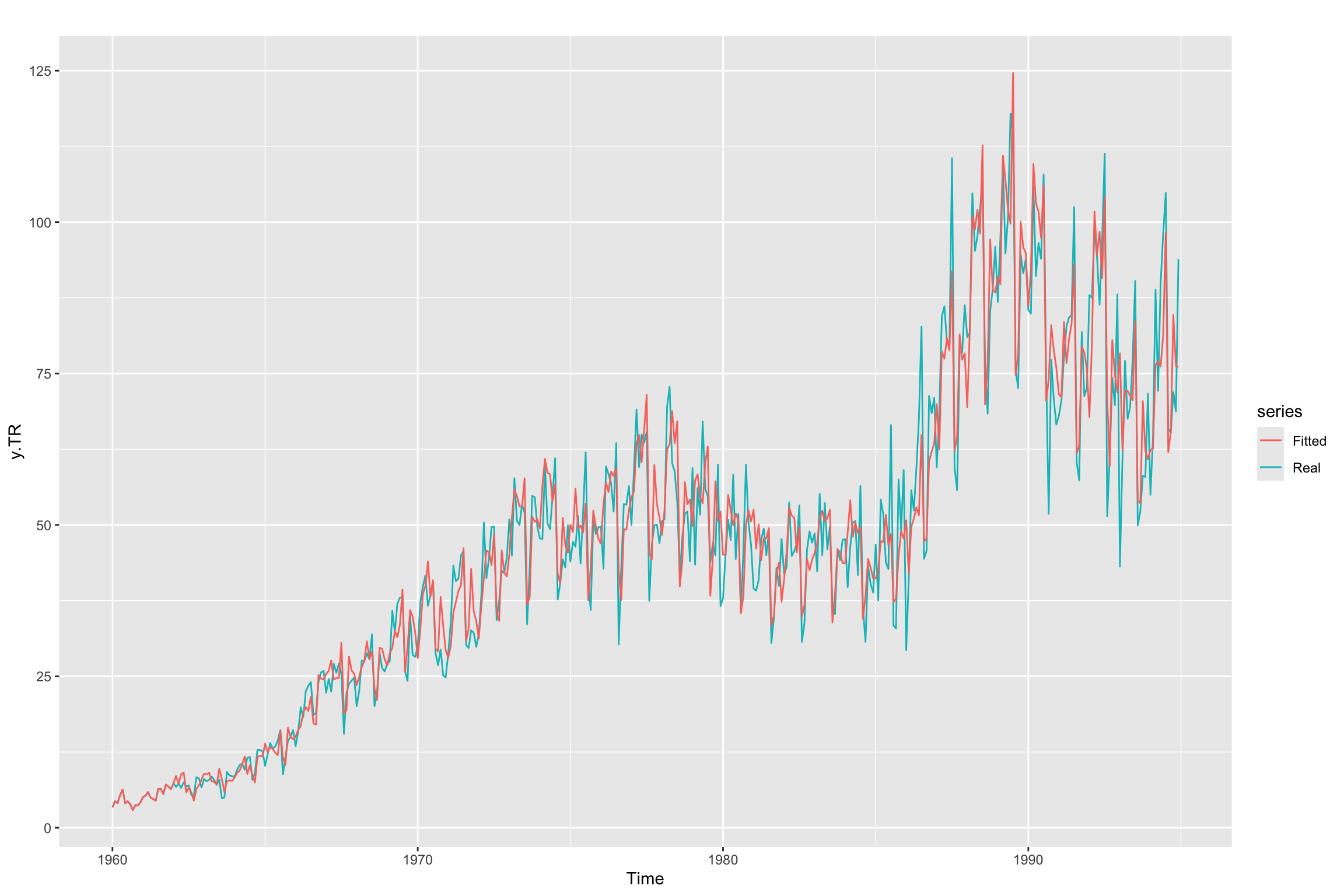

Check the fitted values

# Line 94 of Lab4

autoplot(y.TR, series = "Real") +

forecast::autolayer(arima.fit$fitted, series = "Fitted")

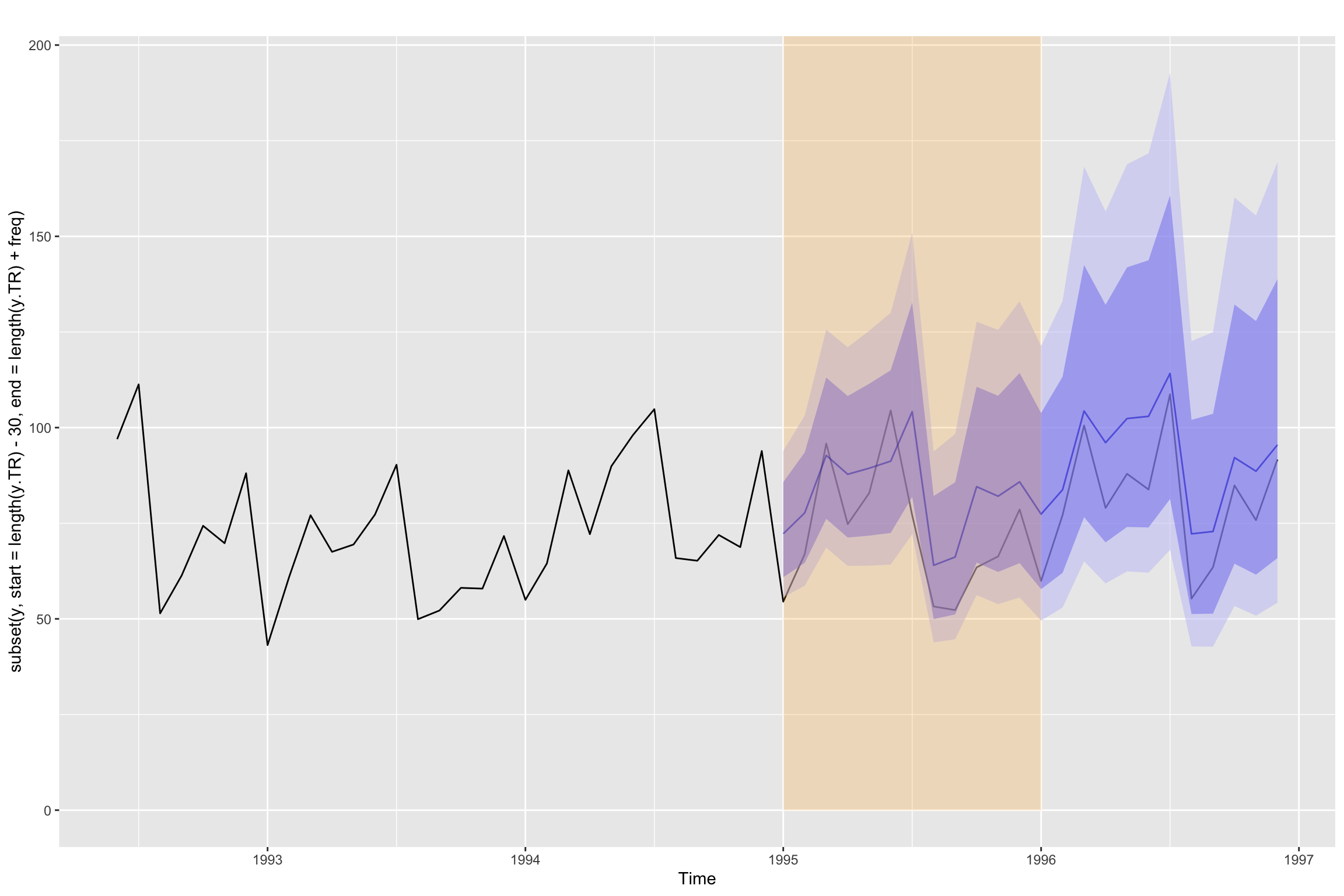

Future forecast and validation

# Line 99 of Lab4

y_est <- forecast::forecast(y.TR, model=arima.fit, h=freq)

head(y_est$mean, n = 12) Jan Feb Mar Apr May Jun Jul

1995 72.24402 77.72355 92.74988 87.79493 89.38275 91.23070 104.15455

Aug Sep Oct Nov Dec

1995 64.00357 66.17088 84.55637 82.06407 85.81810xmin <- 1995

xmax <- 1996

ymin <- 0

ymax <- Inf

autoplot(subset(y, start=length(y.TR) - 30, end=length(y.TR) + freq)) +

autolayer(y_est, alpha = 0.5) +

annotate("rect", xmin=xmin, xmax=xmax, ymin=ymin, ymax= ymax, alpha=0.2, fill="orange")

Validation error for h = 1

Obtain the forecast in validation for horizon = 1 using the trained parameters of the model. We loop through the validation period, adding one point of the time series each time and forecasting the next value (h = 1).

# Line 104 of Lab4

y.TV.est <- y * NA# Line 106 of Lab4

for (i in seq(length(y.TR) + 1, length(y), 1)){

y.TV.est[i] <- forecast::forecast(subset(y, end=i-1),

model = arima.fit,

h=1)$mean

}Next we plot the series and both forecasts. We limit the values depicted in the plot to improve the visualization. As you can see the loop forecasts (with h = 1) appear to be better than the h=12 forecasts in y_est.

# Line 116 of Lab4

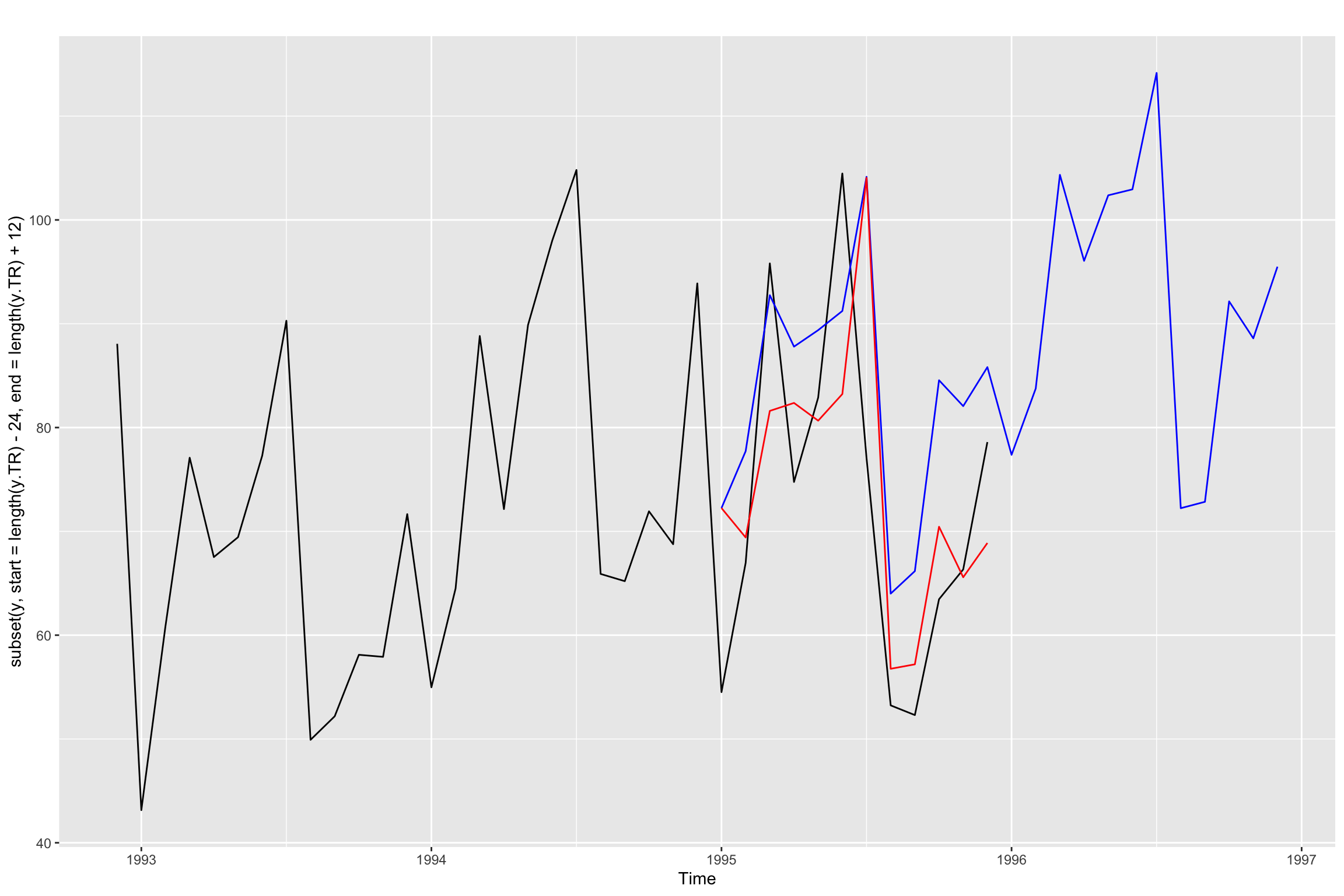

autoplot(subset(y, start=length(y.TR) - 24, end = length(y.TR) + 12)) +

forecast::autolayer(y_est$mean, color="blue") +

forecast::autolayer(subset(y.TV.est, start = length(y.TR) + 1,

end = length(y.TR) + 12), color="red")

Finally we compute the validation errors

# Line 120 of Lab4

accuracy(subset(y.TV.est, start = length(y.TR) + 1), y) ME RMSE MAE MPE MAPE ACF1 Theil's U

Test set 1.643639 10.10724 7.91742 0.04251236 8.459256 -0.238131 0.425696Uncomment the following line to see the direct computation of RSME

sqrt(mean((y.TV.est - y.TV)^2))[1] 10.10724Additional Code

We have seen above that the result of using forecast is different from the result of the validation loop. Both are using the fitted model to forecast, so what is the difference?

Below we will explicitly use the fitted model coefficients to obtain the forecasted values, both for the validation loop and for the forecast function. Keep in mind that the Arima function incorporates the BoxCox transformation. So to make things simpler, we will work directly with z instead of y.

Recall that the equation of our model is: \[ (1 - \Phi_1B^{12})(1 - B)(1 - B^{12})z_t = (1 - \theta_1 B)(1 - \Theta_1 B^{12})\epsilon_t \] But we can expand this equation and reorganize it into a forecasting equation: \[ z_t = z_t = z_{t-1} + z_{t-12} - z_{t-13} + \Phi_1 (z_{t-12} - z_{t-13} - z_{t-24} + z_{t-25}) + \\ \epsilon_t + \theta_1 \epsilon_{t-1} + \Theta_1 \epsilon_{t-12} + \theta_1 \Theta_1 \epsilon_{t-13} \] Similarly we can do the same with the error term to get \[ \epsilon_t = z_t - z_{t-1} - z_{t-12} + z_{t-13} - \phi_1 (z_{t-12} - z_{t-13} - z_{t-24} + z_{t-25}) - \\ \theta_1 \epsilon_{t-1} - \Theta_1 \epsilon_{t-12} - \theta_1 \Theta_1 \epsilon_{t-13} \] Section 9.8 of Hyndman & Athanasopoulos (2021) explains how to apply this forecasting equations. In summary:

- When you start forecasting the first values you replace past values of \(z\) with training set values and \(\epsilon\) values with the residuals of the fitted model (also corresponding to training). As you move further into the test set, unknown values of \(z\) and \(\epsilon\) will be needed.

- Note that in order to compute \(z_t\) using the first equation we need \(\epsilon_t\), so we assume that value to be zero.

- The main difference between

forecastand the validation loop is in deciding whether we then use the second equation to update \(\epsilon_t\) for \(t\) values corresponding to the test set. Let us explore this in the code.

So we begin by splitting z into training and test.

Technical note: Lambda was determined using only the training set, and we apply the same Lambda to the test set to prevent data leakage.

z <- BoxCox(y, Lambda)

z.TR <- subset(z, end = length(y.TR))

z.TV <- subset(z, start = length(y.TR) + 1)We fit a seasonal model to z with the same order we used for y, but setting lambda equal to 1.

arima.fit <- Arima(z.TR,

order=c(p, d, q),

seasonal = list(order=c(P, D, Q), period=12),

lambda = 1,

include.constant = FALSE)In the code below you can verify that the model fit is equivalent to what we obtained above for y.

summary(arima.fit)Series: z.TR

ARIMA(0,1,1)(1,1,1)[12]

Box Cox transformation: lambda= 1

Coefficients:

ma1 sar1 sma1

-0.5936 0.2317 -0.9189

s.e. 0.0435 0.0611 0.0394

sigma^2 = 0.01329: log likelihood = 294.41

AIC=-580.82 AICc=-580.72 BIC=-564.78

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.008851714 0.1130747 0.08373548 -0.3647752 2.684318 0.5294322

ACF1

Training set 0.02378263coeftest(arima.fit)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ma1 -0.593623 0.043517 -13.6413 < 2.2e-16 ***

sar1 0.231663 0.061055 3.7943 0.000148 ***

sma1 -0.918918 0.039365 -23.3437 < 2.2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1autoplot(arima.fit)

CheckResiduals.ICAI(arima.fit, bins = 100, lag=100)

Ljung-Box test

data: Residuals from ARIMA(0,1,1)(1,1,1)[12]

Q* = 80.576, df = 97, p-value = 0.8858

Model df: 3. Total lags used: 100Now let us begin using this model to forecast the test set values.

We begin by using the forecast function to forecast all the values in the test set. That is, we set the forecasting horizon h equal to the length of the test set,

z_est <- forecast::forecast(arima.fit, h=length(z.TV))Next we will generate three additional versions of the forecasts, using a loop as we did before.

- The first forecast

z.TV.estis exactly what we did before, but using z instead of y. - The second one

z.TV.est2will use the two forecasting equations (with the fitted coefficients) and will always use actual values of \(z_t\) in the test set. The error terms will also be updated with the second forecasting equation. - The third one

z.TV.est3will also use the forecasting equation, but it will use its own forecasted values of \(z_t\) in the test set. The error terms for \(t\) in the test set will all be set to zero.

First we create empty time series to store the different forecasts.

z.TV.est <- z * NA

z.TV.est2 <- z * NA

z.TV.est3 <- z * NAWe make the training values of \(z_t\) available to the forecasting equation.

z.TV.est[1:length(z.TR)] <- z.TR

z.TV.est2[1:length(z.TR)] <- z.TR

z.TV.est3[1:length(z.TR)] <- z.TRSimilarly, we prepare two versions of \(\epsilon_t\) containing the training residuals, to be used by the second and third procedure. Even though they look initially the same, these error terms are updated differently: the second procedure really updates them with a forecast equation, whereas the third one leaves the test error values as 0.

w2 <- z * 0

w2[1:length(z.TR)] <- residuals(arima.fit)

w3 <- z * 0

w3[1:length(z.TR)] <- residuals(arima.fit)We store the coefficients of the model (_s indicates seasonal)

Phi_s <- coefficients(arima.fit)["sar1"]

theta <- coefficients(arima.fit)["ma1"]

Theta_s <- coefficients(arima.fit)["sma1"]And now we get the forecasts in a loop.

for (i in seq(length(z.TR) + 1, length(y), 1)){# loop for validation period

# The first one is simply what we did in the validation loop above

z.TV.est[i] <- forecast::forecast(subset(z, end=i-1),

model = arima.fit,

h=1)$mean

# In the second forecast procedure we use the two forecasting equations, with

# real values of z and updating the errors with the second equation.

z.TV.est2[i] <- z[i - 1] + z[i - 12] - z[i-13] +

Phi_s * (z[i-12] - z[i-13] - z[i - 24] + z[i-25]) +

w2[i] + theta * w2[i - 1] + Theta_s * w2[i - 12] + theta * Theta_s * w2[i - 13]

w2[i] = z[i] - z[i-1] - z[i-12] + z[i-13] -

Phi_s * (z[i-12] - z[i-13] - z[i-24] + z[i-25]) -

theta * w2[i-1] - Theta_s * w2[i-12] - theta * Theta_s * w2[i-13]

# And in the third one we update the forecasted values z.TV.est3 using their

# previous values and we do not update the error terms (they stay 0)

z.TV.est3[i] <- z.TV.est3[i - 1] + z.TV.est3[i - 12] - z.TV.est3[i-13] +

Phi_s * (z.TV.est3[i-12] - z.TV.est3[i-13] - z.TV.est3[i - 24] + z.TV.est3[i-25]) +

w3[i] + theta * w3[i - 1] + Theta_s * w3[i - 12] + theta * Theta_s * w3[i - 13]

}Let us examine the results, comparing the first values for all the forecast procedures:

k <- 10Using forecast function directly (we called this s_est above):

head(z_est$mean, k) Jan Feb Mar Apr May Jun Jul Aug

1995 4.099109 4.179055 4.388351 4.294830 4.369889 4.398921 4.499703 4.063269

Sep Oct

1995 4.066478 4.261535Using the validation loop as explained in today’s session

subset(z.TV.est, start = length(z.TR) + 1, end = length(z.TR) + k) Jan Feb Mar Apr May Jun Jul Aug

1995 4.099109 4.070260 4.258979 4.200732 4.243077 4.260375 4.427713 3.877607

Sep Oct

1995 3.853199 4.023954Using the two forecast equations with actual z values and error updates

subset(z.TV.est2, start = length(z.TR) + 1, end = length(z.TR) + k) Jan Feb Mar Apr May Jun Jul Aug

1995 4.099130 4.070274 4.258966 4.200749 4.243050 4.260350 4.427711 3.877596

Sep Oct

1995 3.853198 4.023978Using only the forecasting equation for y and no error update

subset(z.TV.est3, start = length(z.TR) + 1, end = length(z.TR) + k) Jan Feb Mar Apr May Jun Jul Aug

1995 4.099130 4.179070 4.388345 4.294849 4.369871 4.398893 4.499688 4.063245

Sep Oct

1995 4.066459 4.261540The results indicate that, up to small rounding errors there are only two different results:

- the validation loop is doing what we called the second procedure.

- the

forecastfunction is doing what twe called the third procedure.

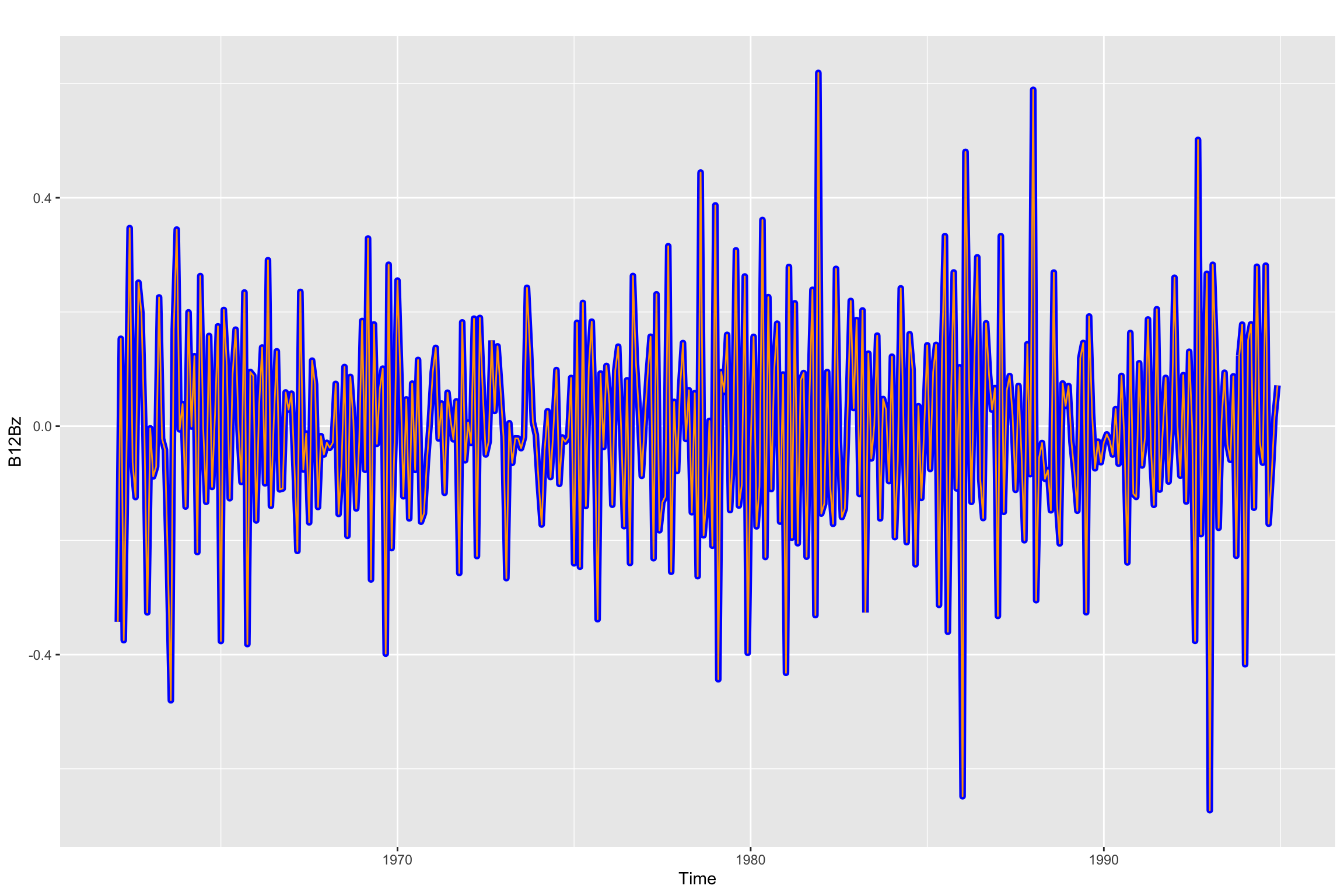

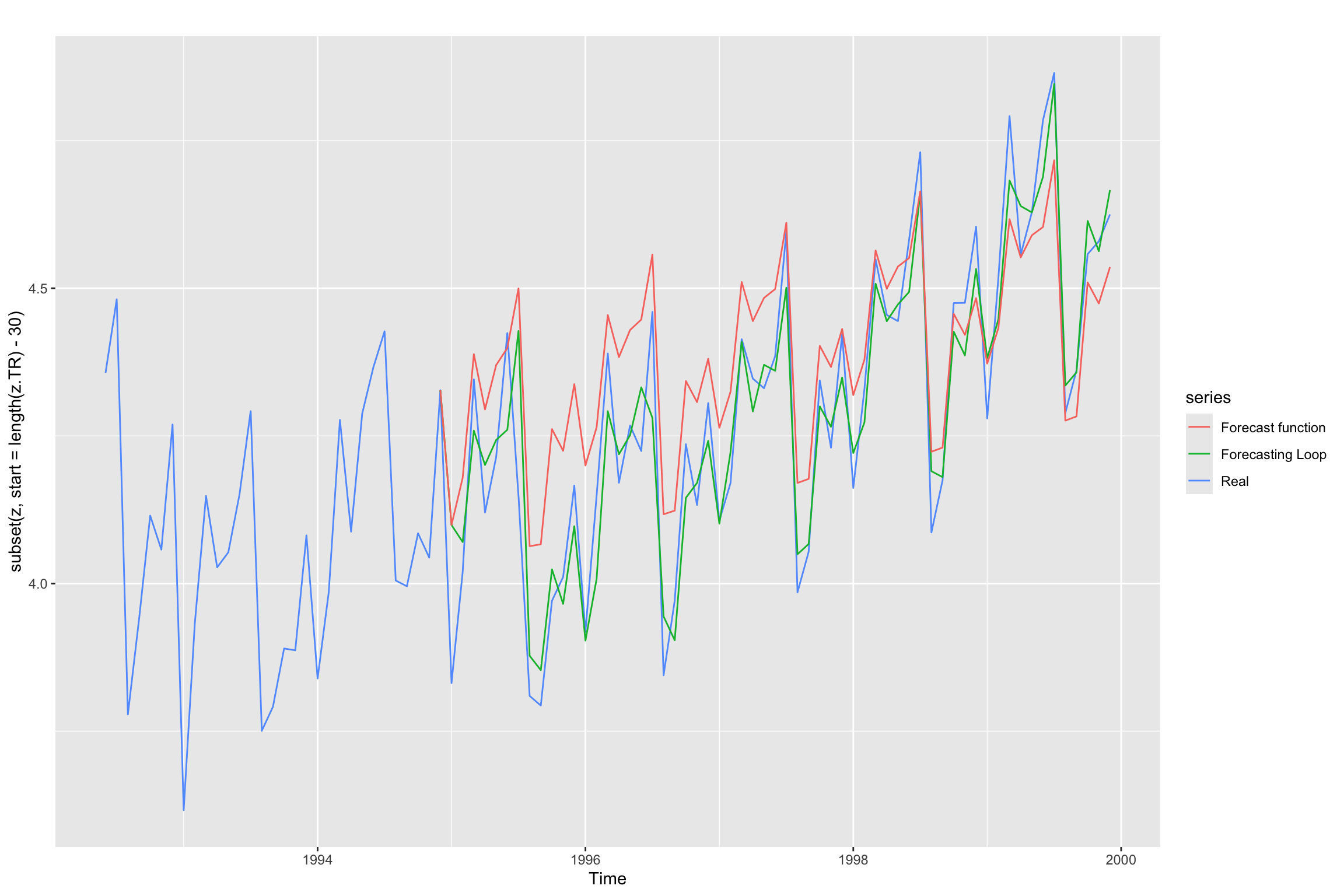

The updated error values and the use of actual values of the time series explain why the validation loop produces more accurate values. This is illustrated in the plot below:

autoplot(subset(z, start = length(z.TR) - 30), series="Real") +

forecast::autolayer(subset(z.TV.est, start = length(z.TR)), series="Forecasting Loop") +

forecast::autolayer(subset(z.TV.est3, start = length(z.TR)), series="Forecast function")

Now we can also compare both approaches through their validation errors.

accuracy(z_est, z) ME RMSE MAE MPE MAPE MASE

Training set -0.008851714 0.1130747 0.08373548 -0.3647752 2.684318 0.5294322

Test set -0.082613248 0.1493240 0.12528694 -2.0788375 2.996520 0.7921486

ACF1 Theil's U

Training set 0.02378263 NA

Test set 0.56407002 0.6401048accuracy(z.TV.est, z) ME RMSE MAE MPE MAPE ACF1

Test set 0.0004523454 0.030467 0.00842029 0.003263153 0.1975652 -0.1771778

Theil's U

Test set 0.1090504As expected, direct use of the forecast function leads to worse predictive performance in the test set.