#####################################################################

########## Lab Practice 2: ARMA models ###########

#####################################################################2025_09_10 Stochastic Processes, ARMA Processes, lecture notes

Load the required libraries

MLTools setup

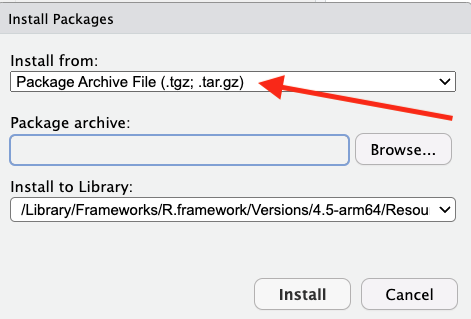

MLTools is a library of R functions developed here at ICAI. To install it you need to download the compressed code file from this link to Moodle:

Then in RStudio use the Packages tab in the bottom right panel, click the Install button and then, in the window that opens, make sure to select Package Archive File as indicated below:

Navigate to the folder where you downloaded the MLTools file, select that file with Open, and then click Install.

After that you can proceed to load the remaining libraries. You may also need to install lmtest (using CRAN this time).

library(MLTools)

library(fpp2)

library(tidyverse)

library(readxl)

library(lmtest) #contains coeftest functionSet working directory

setwd(dirname(rstudioapi::getActiveDocumentContext()$path))White Noise

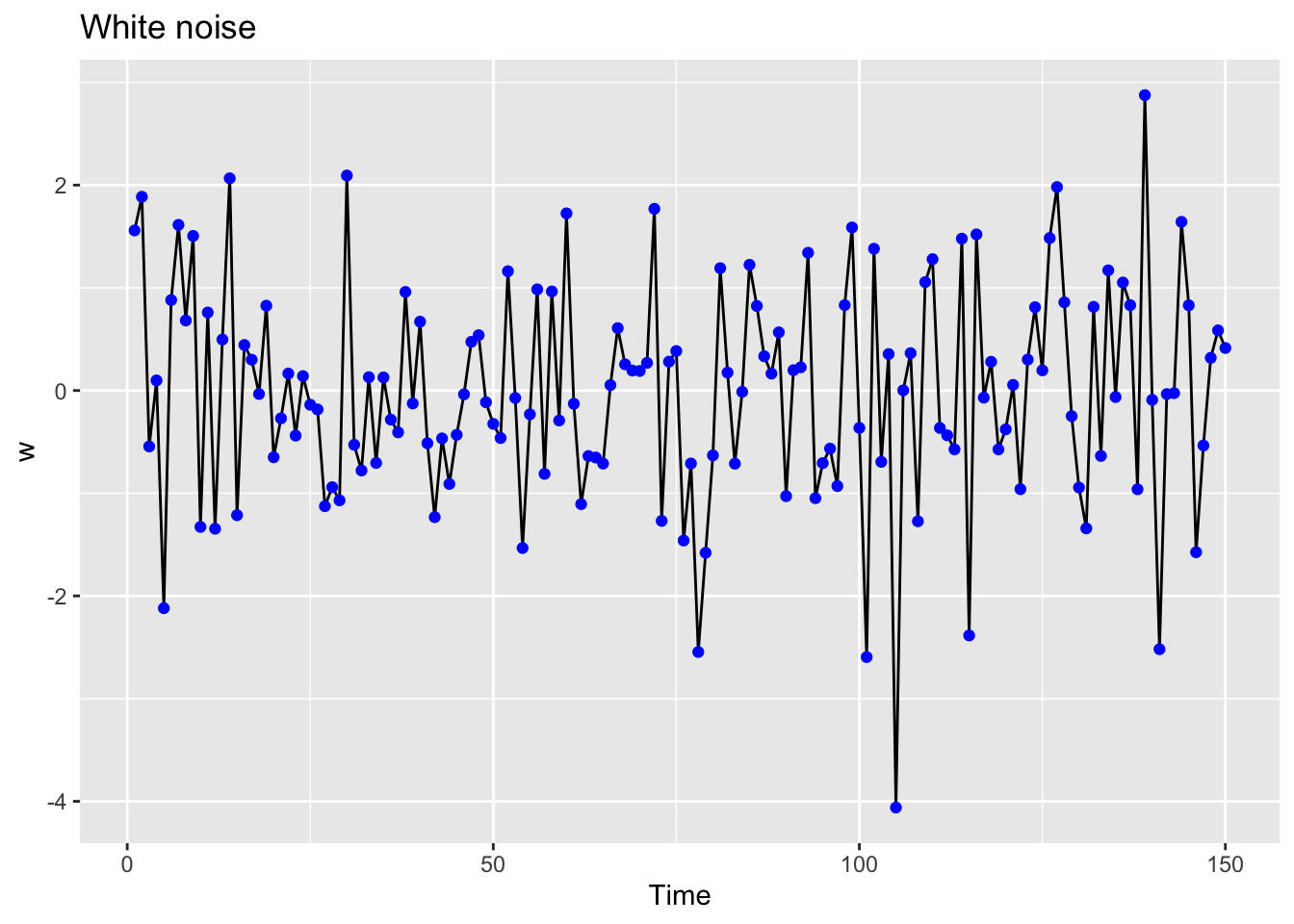

We will create a gaussian white noise time series. In order to do that we get a sample of n random values from a standard normal.

n <- 150

z <- rnorm(n, mean = 0, sd = 1) 0 and 1 are the default values for rnorm so this is equivalent to `rnorm(n)``

head(z, 30) [1] 1.55858444 1.88605293 -0.54480851 0.09826612 -2.11960663 0.88079929

[7] 1.61280608 0.68176821 1.50499205 -1.32818990 0.75962654 -1.34579344

[13] 0.49662004 2.06606039 -1.21395880 0.44334923 0.30004169 -0.03351126

[19] 0.82571279 -0.64969804 -0.27118124 0.16515272 -0.43916555 0.14059576

[25] -0.13853486 -0.18418089 -1.12632653 -0.94126725 -1.06966681 2.09340887Now we use this to define a ts object. Note that now we are not providing the frequency, start, etc. In this case, the ts function will create a time index using the natural numbers t = 1, 2, 3, …

w <- ts(z)

head(w, 25)Time Series:

Start = 1

End = 25

Frequency = 1

[1] 1.55858444 1.88605293 -0.54480851 0.09826612 -2.11960663 0.88079929

[7] 1.61280608 0.68176821 1.50499205 -1.32818990 0.75962654 -1.34579344

[13] 0.49662004 2.06606039 -1.21395880 0.44334923 0.30004169 -0.03351126

[19] 0.82571279 -0.64969804 -0.27118124 0.16515272 -0.43916555 0.14059576

[25] -0.13853486Time plot of the white noise time series:

autoplot(w) +

ggtitle("White noise") +

geom_point(aes(x = 1:n, y = z), size=1.5, col="blue")

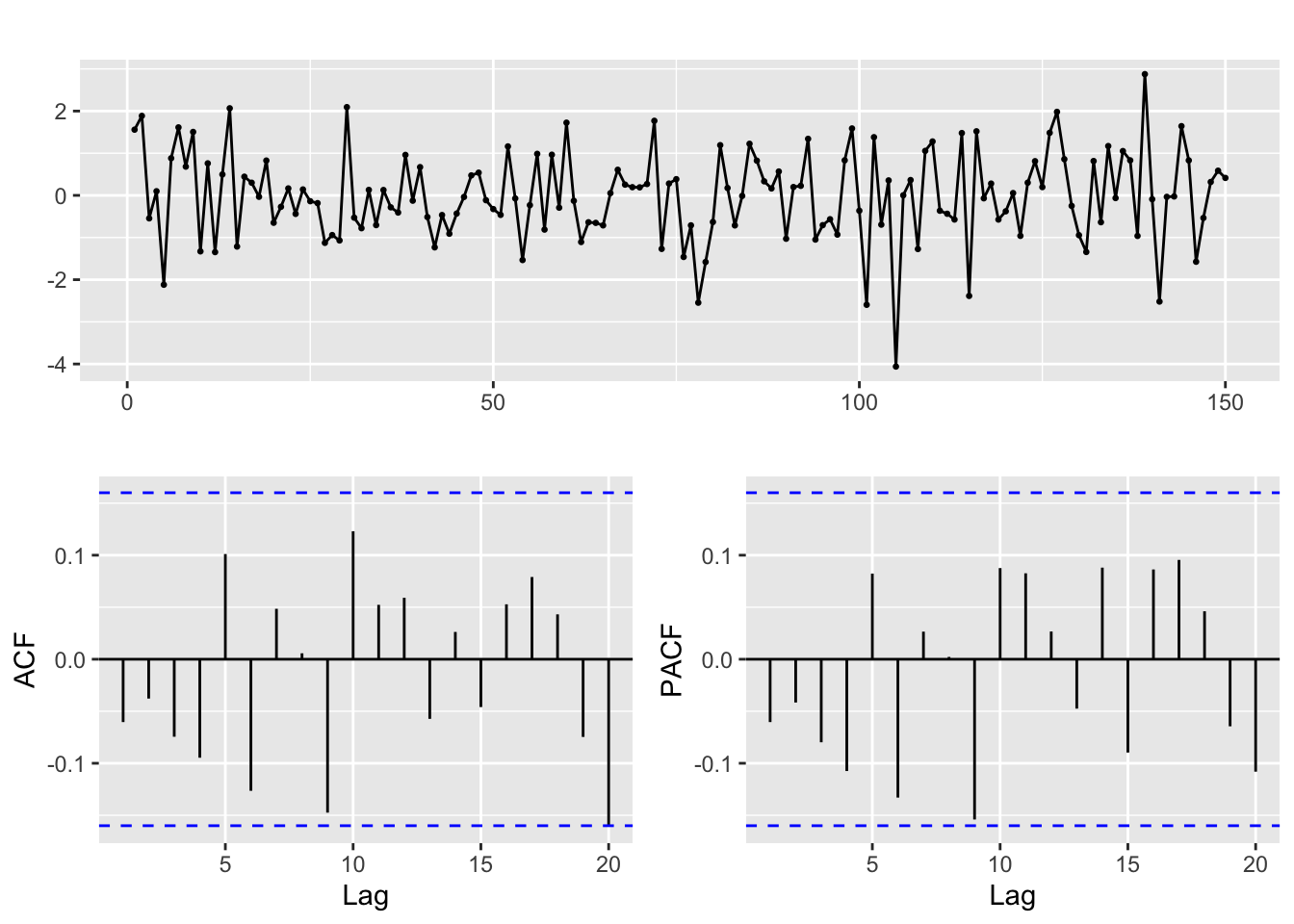

ACF and PACF of white noise

ggtsdisplay(w, lag.max = 20)

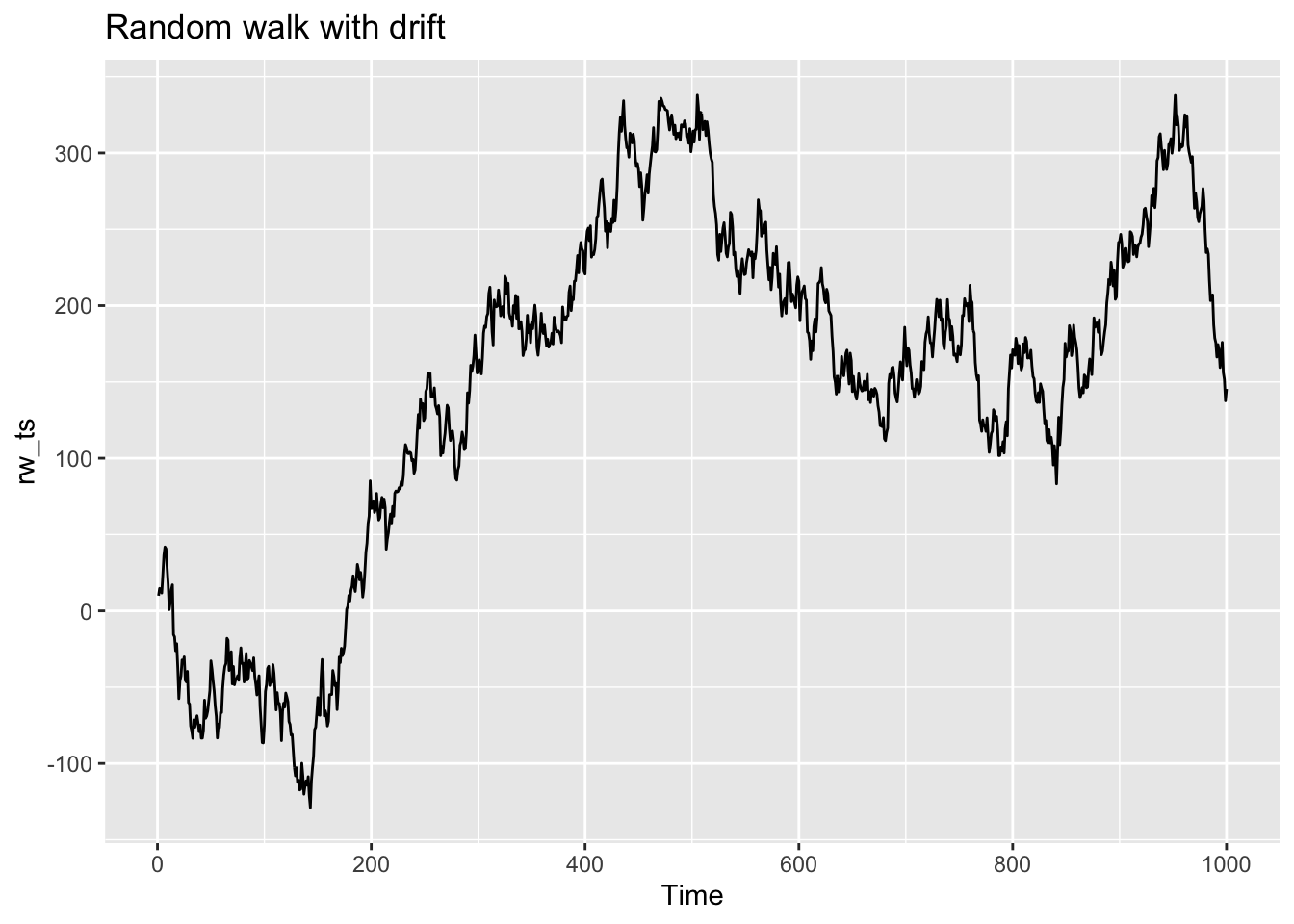

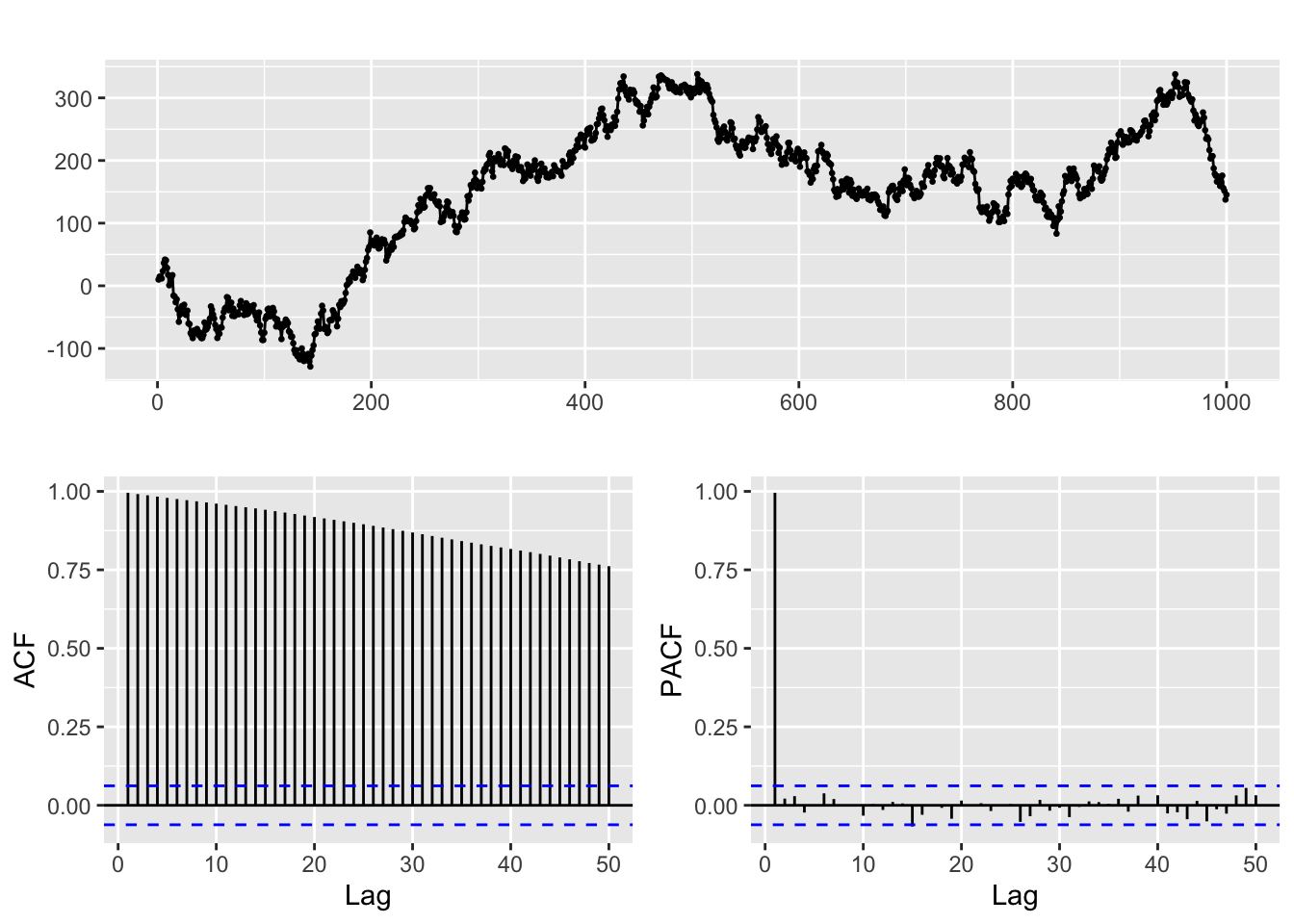

Random walks

A random walk is an stochastic process usually defined by the recursive equation: \[y_t = k + y_{t-1} + w_t\] where \(w_t\) is white noise. The value \(k\) is the drift constant. If we set \(y_0 = 0\) an equivalent definition of random walk is: \[y_t = k\cdot t + w_1 + w_2 + ... + w_t\]

Let us use this to simulate n values of a random walk with drift:

n = 1000

set.seed(2024)

# Let k be the drift constant

k = 0.1

# Create the white noise time series values:

w = 10 * rnorm(n)

# and then

rw_ts = ts(k * (1:n) + cumsum(w))This is the time plot, note that it does not look like noise any more!

autoplot(rw_ts) +

ggtitle("Random walk with drift")

ACF and PACF of random walk

ggtsdisplay(rw_ts, lag.max = 50)

The presence of the linear trend translates into a slow decay in the ACF

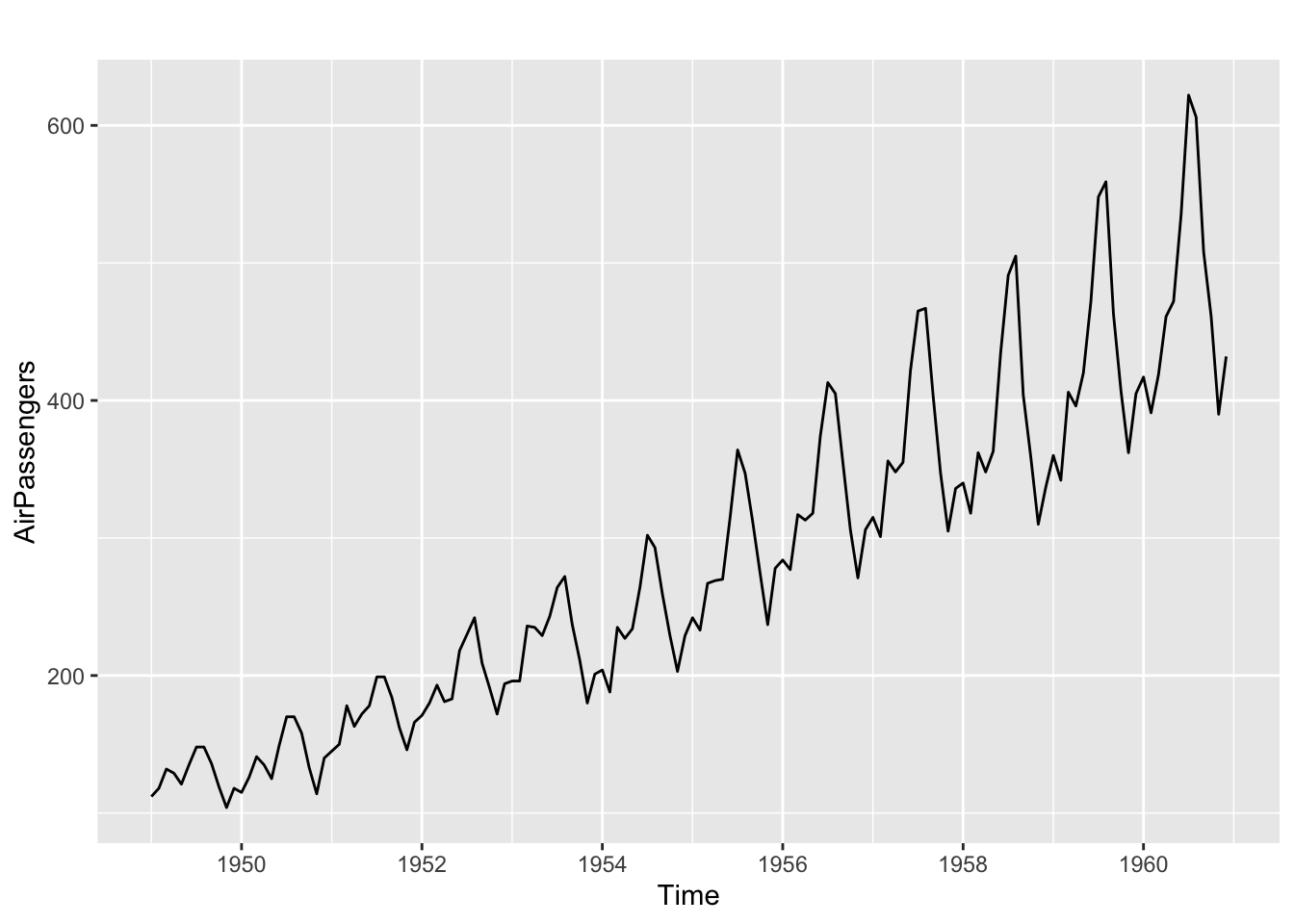

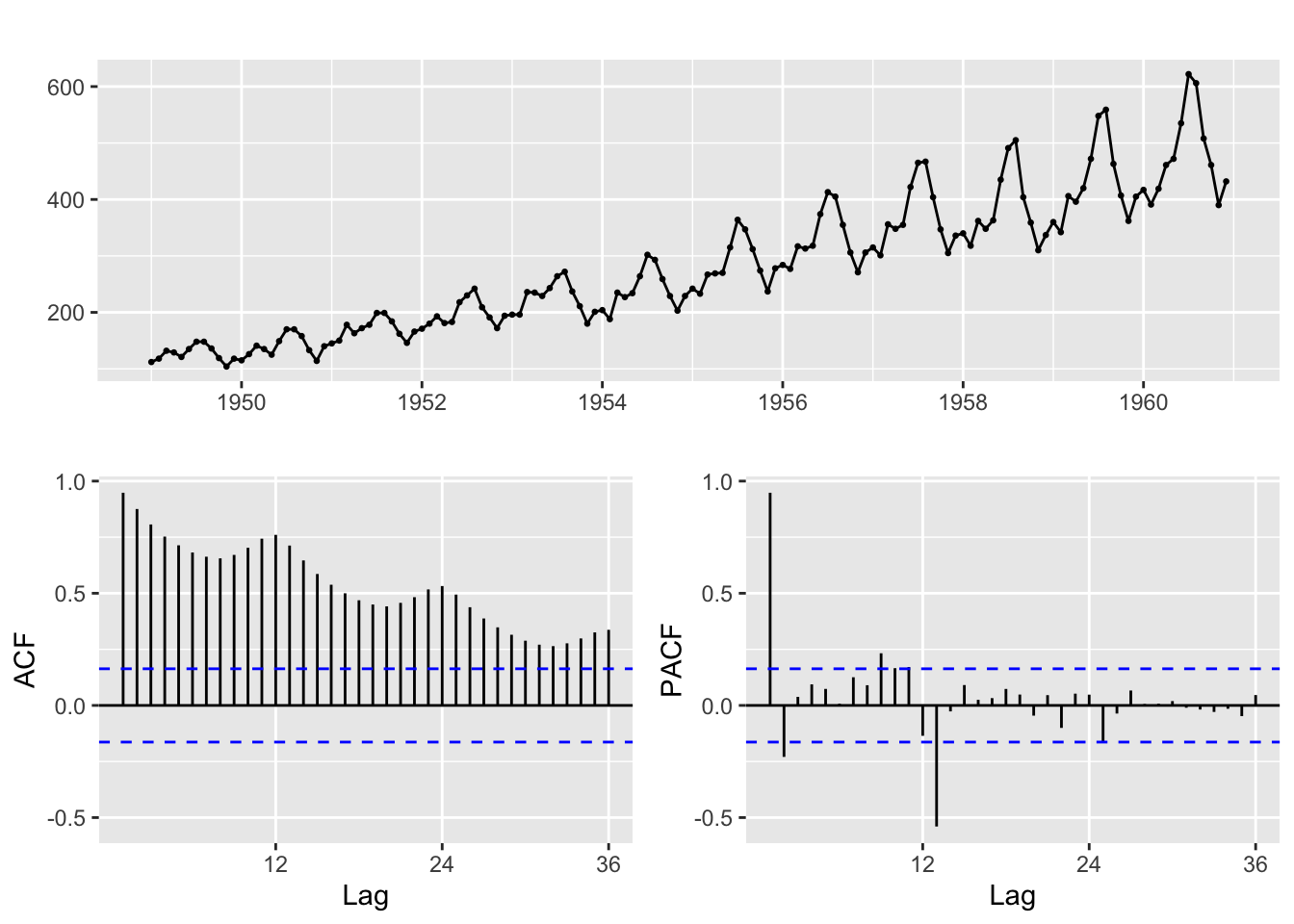

ACF for a seasonal series

For a seasonal series the ACF function also displays patterns related to the seasonal period:

autoplot(AirPassengers)

sp = 12

# ACF and PACF

ggtsdisplay(AirPassengers)

To examine the individual ACF values we can use:

Acf(AirPassengers,lag.max = 2 * sp, plot = FALSE)

Autocorrelations of series 'AirPassengers', by lag

0 1 2 3 4 5 6 7 8 9 10 11 12

1.000 0.948 0.876 0.807 0.753 0.714 0.682 0.663 0.656 0.671 0.703 0.743 0.760

13 14 15 16 17 18 19 20 21 22 23 24

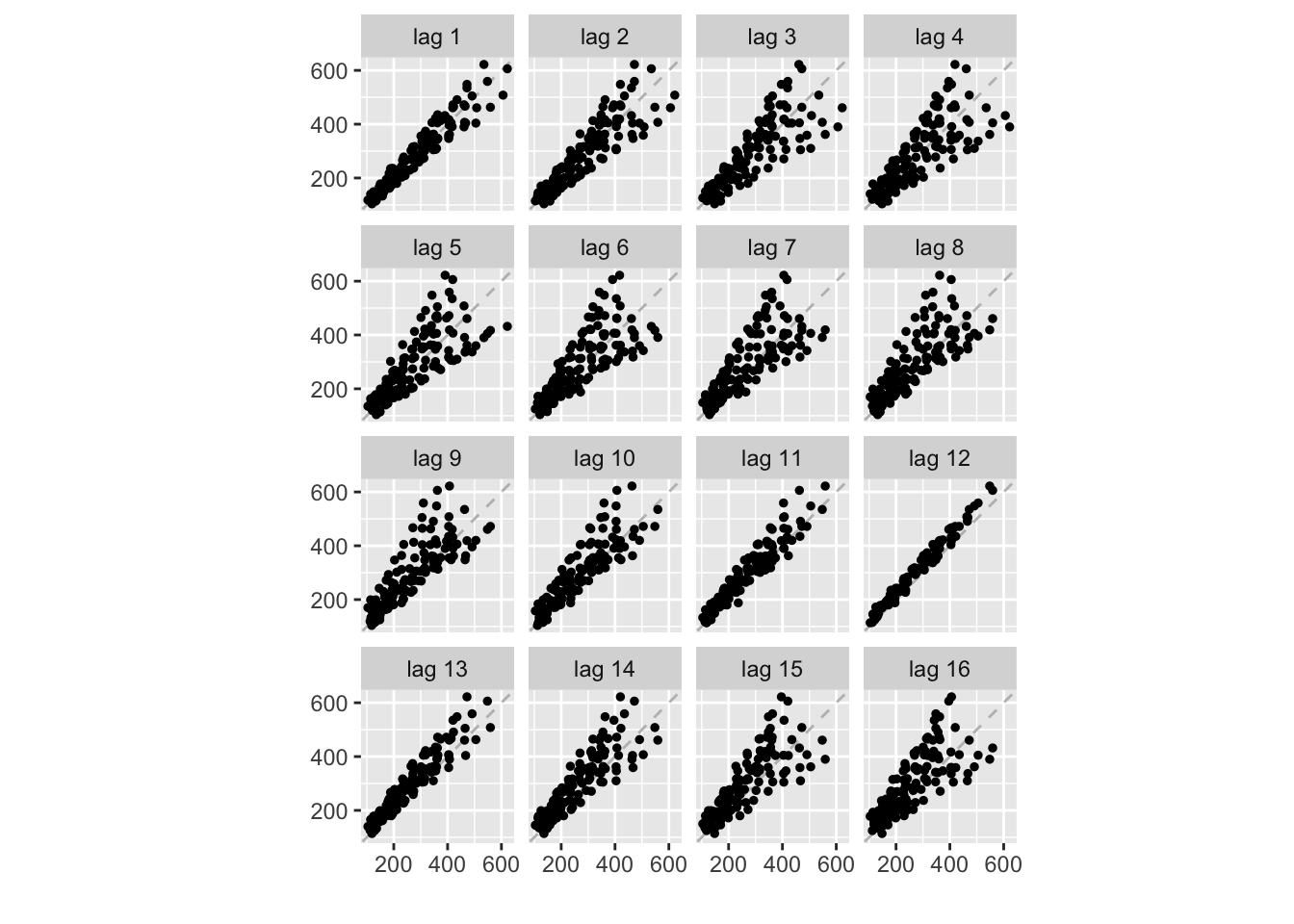

0.713 0.646 0.586 0.538 0.500 0.469 0.450 0.442 0.457 0.482 0.517 0.532 And to visualize the correlation between lagged versions of the time series we can use a lag plot:

gglagplot(AirPassengers, seasonal = FALSE, do.lines = FALSE, colour = FALSE)

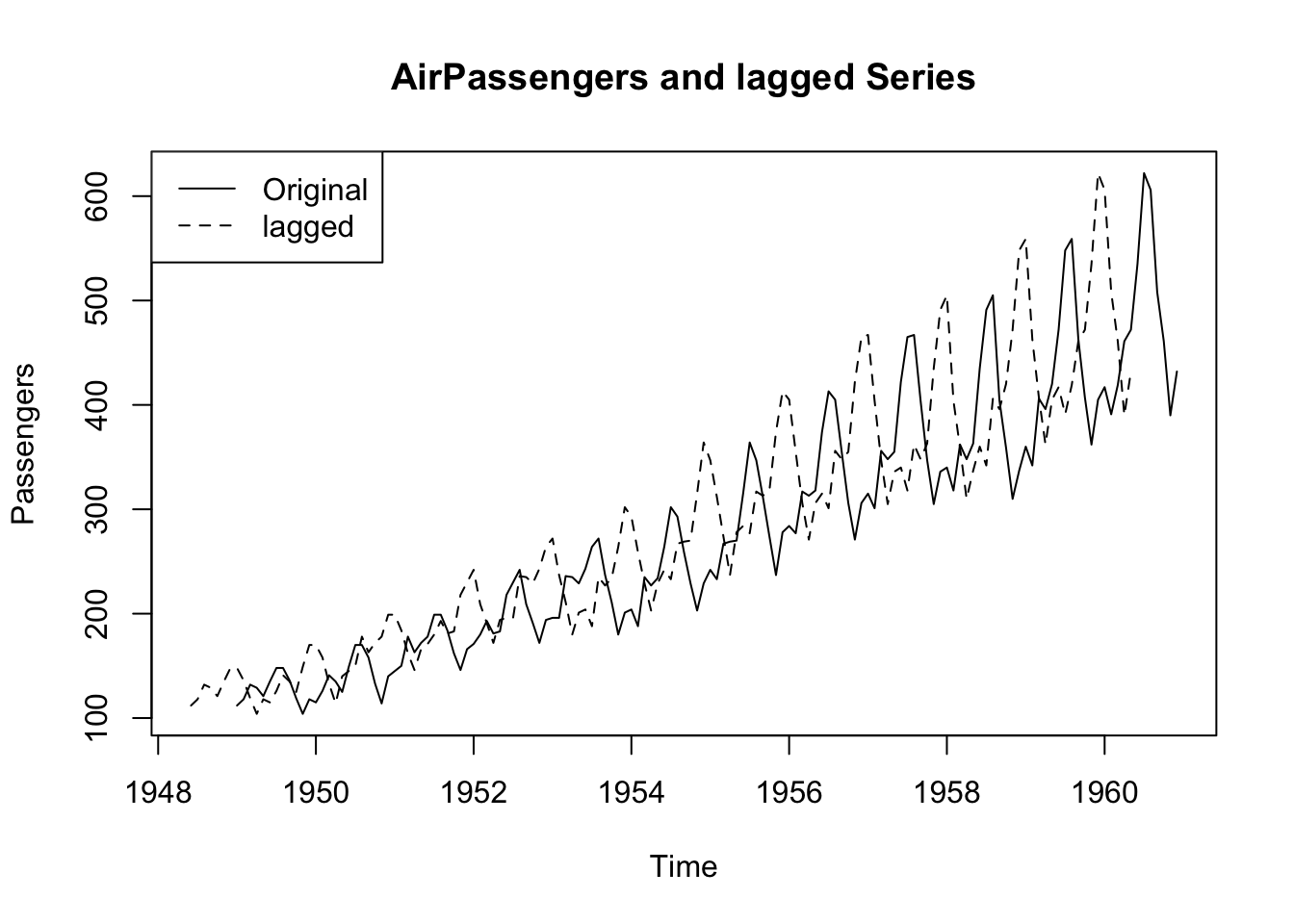

We can also examine a time plot of the series and its lagged version to understand what is happening:

k <- 7

lagged <- stats::lag(AirPassengers, k)

AirPassengers_lag <- cbind(Original = AirPassengers, lagged = lagged)

head(AirPassengers_lag, k + 2) Original lagged

Jun 1948 NA 112

Jul 1948 NA 118

Aug 1948 NA 132

Sep 1948 NA 129

Oct 1948 NA 121

Nov 1948 NA 135

Dec 1948 NA 148

Jan 1949 112 148

Feb 1949 118 136ts.plot(AirPassengers_lag,

lty = 1:2,

main = "AirPassengers and lagged Series",

ylab = "Passengers", xlab = "Time")

legend("topleft", legend = c("Original", "lagged"),

lty = 1:2)

ARMA processes

Now let us turn to ARMA processes

# Line 14

## Load dataset

fdata <- read_excel("ARMA_series.xls")

#fdata <- read_excel("ARMA_Hackaton_data.xls")# Line 18

# Convert to time series object

fdata_ts <- ts(fdata)

head(fdata_ts)Time Series:

Start = 1

End = 6

Frequency = 1

y1 y2 y3 y4 y5 y6

1 0.00000000 0.0000000 0.00000000 0.000000 0.00000000 0.0000000

2 0.15308507 -0.7165780 -1.71442720 0.000000 1.67224070 -0.4915498

3 -0.40741828 -0.3887689 0.06525109 1.450110 -0.25668180 1.6003533

4 0.03831497 0.3933029 0.50867057 1.845359 -0.09947878 -0.5246700

5 -0.05568611 -1.3998697 -0.23749804 4.164812 -1.09044400 0.3197939

6 0.08986429 0.8092756 -0.63004594 2.951456 3.49057750 -0.6224836# Line 23

# index to select a time series

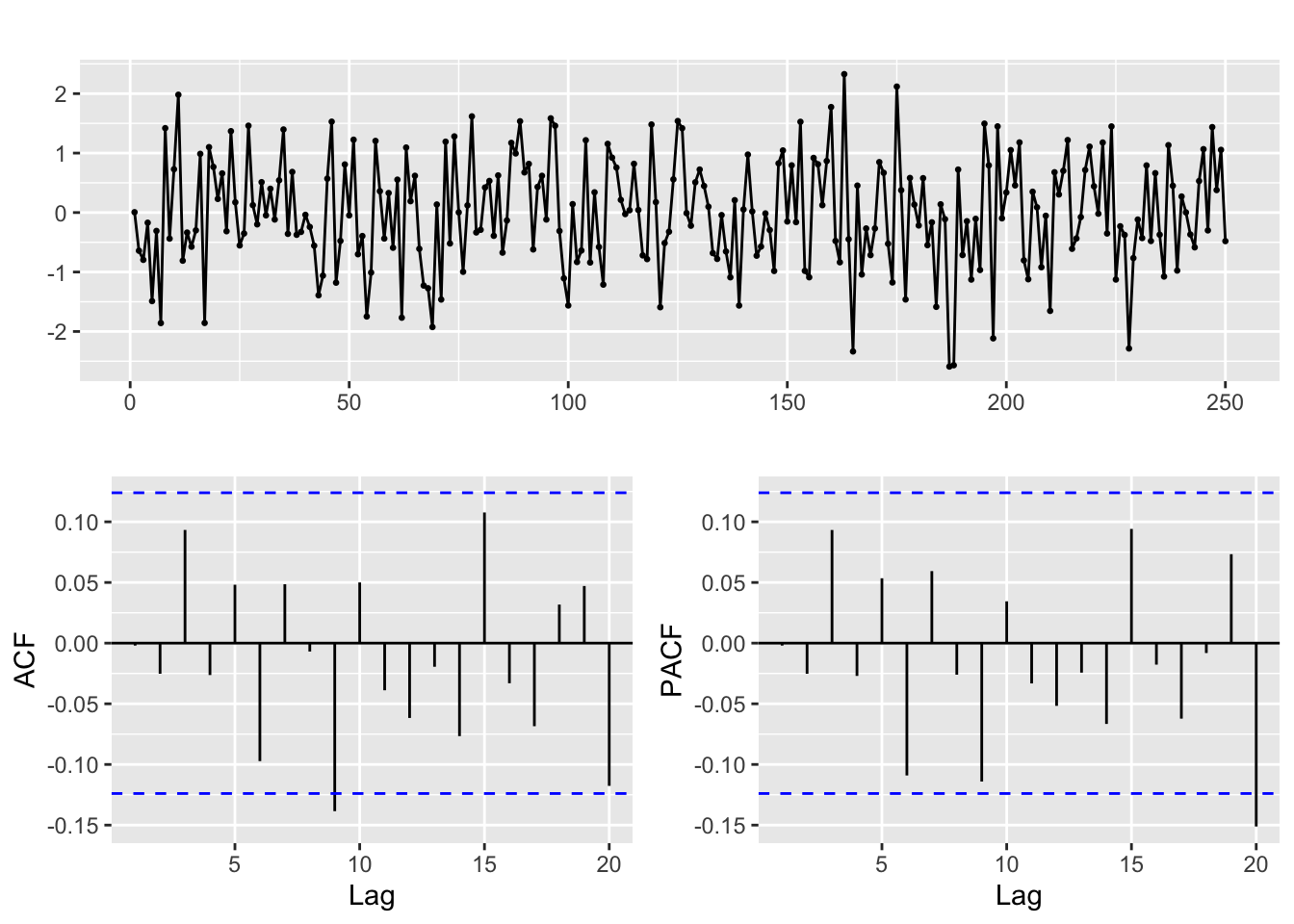

y <- fdata_ts[ ,2]# Line 27

## Identification and fitting frocess -------------------------------------------------------------------------------------------------------

# ACF and PACF of the time series -> identify significant lags and order

ggtsdisplay(y, lag.max = 20)

# Line 32

# Fit model with estimated order

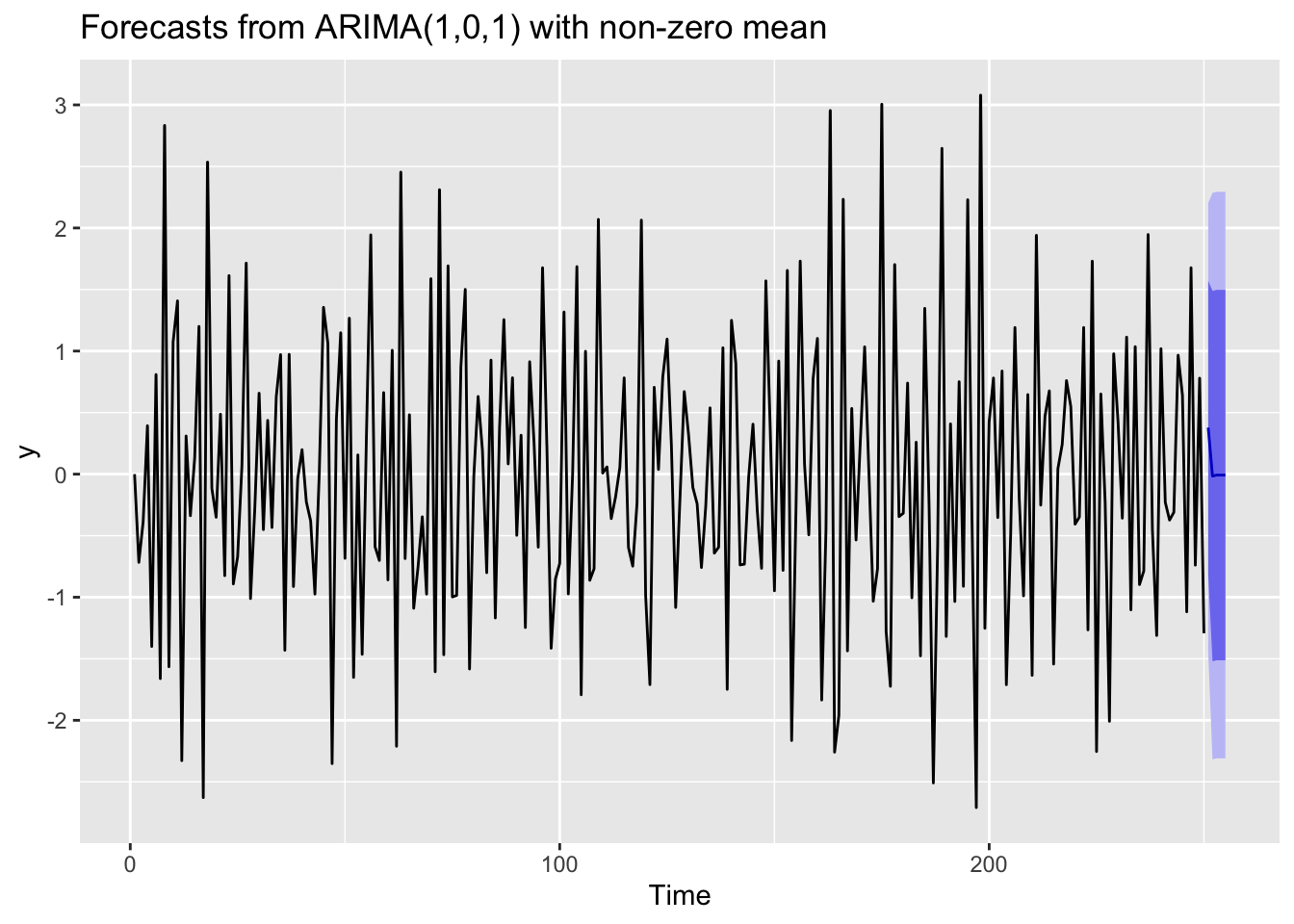

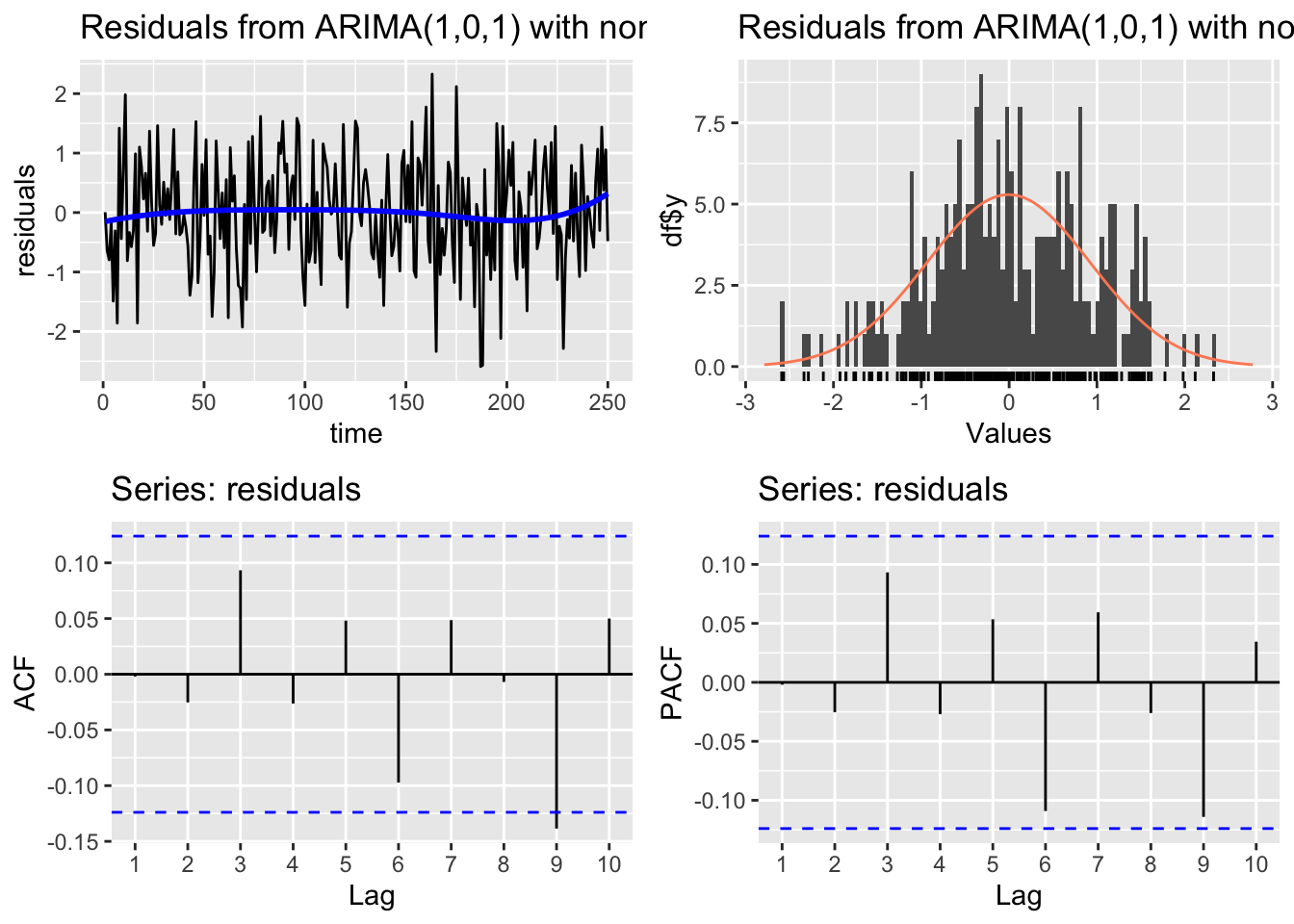

arima.fit <- Arima(y, order=c(1,0,1), include.mean = TRUE)

summary(arima.fit) # summary of training errors and estimated coefficientsSeries: y

ARIMA(1,0,1) with non-zero mean

Coefficients:

ar1 ma1 mean

-0.0209 -0.7476 -0.0077

s.e. 0.0895 0.0648 0.0146

sigma^2 = 0.8666: log likelihood = -335.76

AIC=679.51 AICc=679.68 BIC=693.6

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set -0.006359145 0.9253249 0.7463957 Inf Inf 0.4566577 -0.001999382# Line 37

coeftest(arima.fit) # statistical significance of estimated coefficients

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -0.0209400 0.0894843 -0.2340 0.8150

ma1 -0.7475557 0.0647692 -11.5418 <2e-16 ***

intercept -0.0076721 0.0146470 -0.5238 0.6004

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1# Line 39

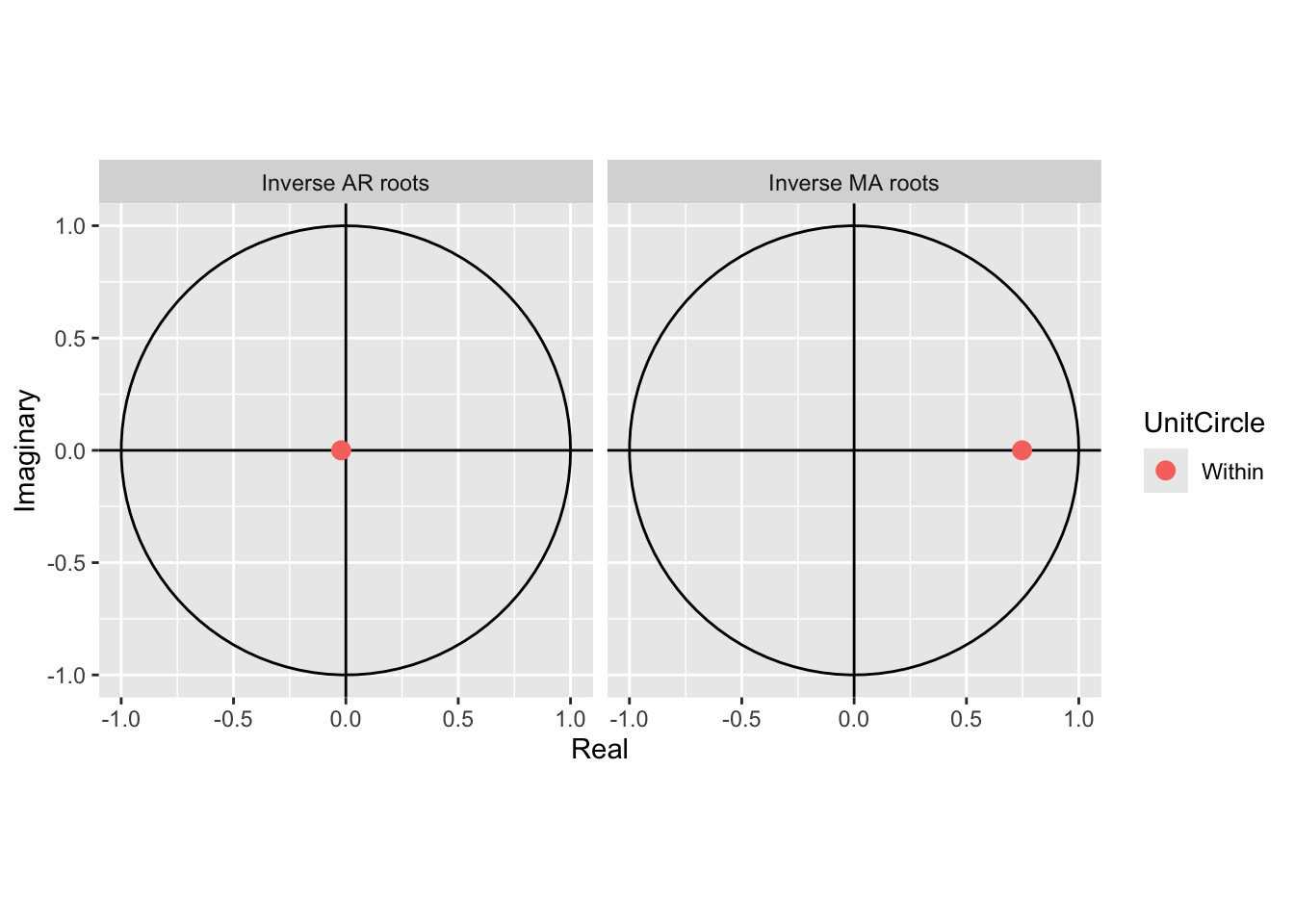

autoplot(arima.fit) # root plot

# Line 41

# Check residuals

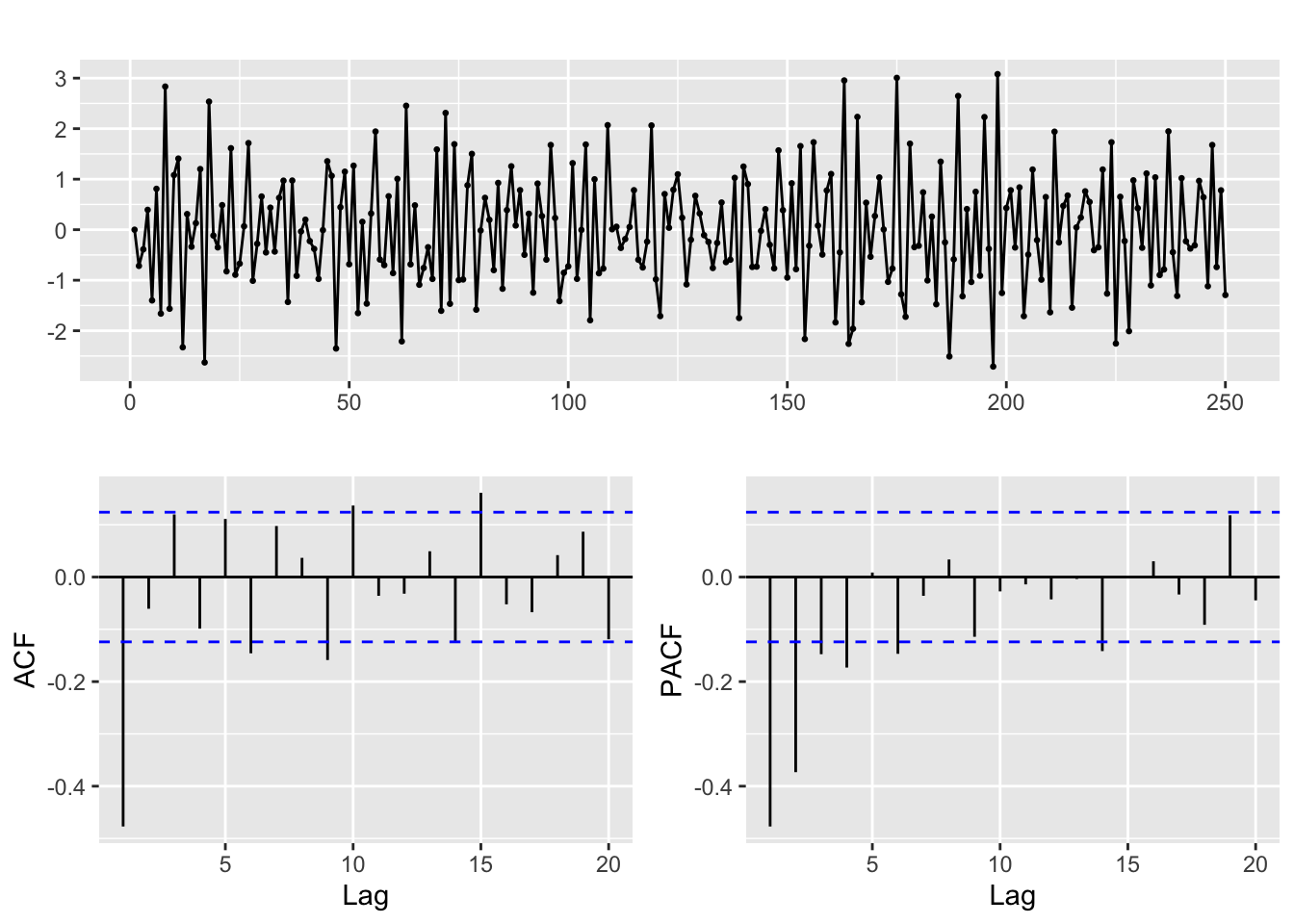

CheckResiduals.ICAI(arima.fit, bins = 100, lags = 20)

Ljung-Box test

data: Residuals from ARIMA(1,0,1) with non-zero mean

Q* = 11.895, df = 7, p-value = 0.1041

Model df: 3. Total lags used: 10# Line 44

# If residuals are not white noise, change order of ARMA

ggtsdisplay(residuals(arima.fit), lag.max = 20)

# Line 49

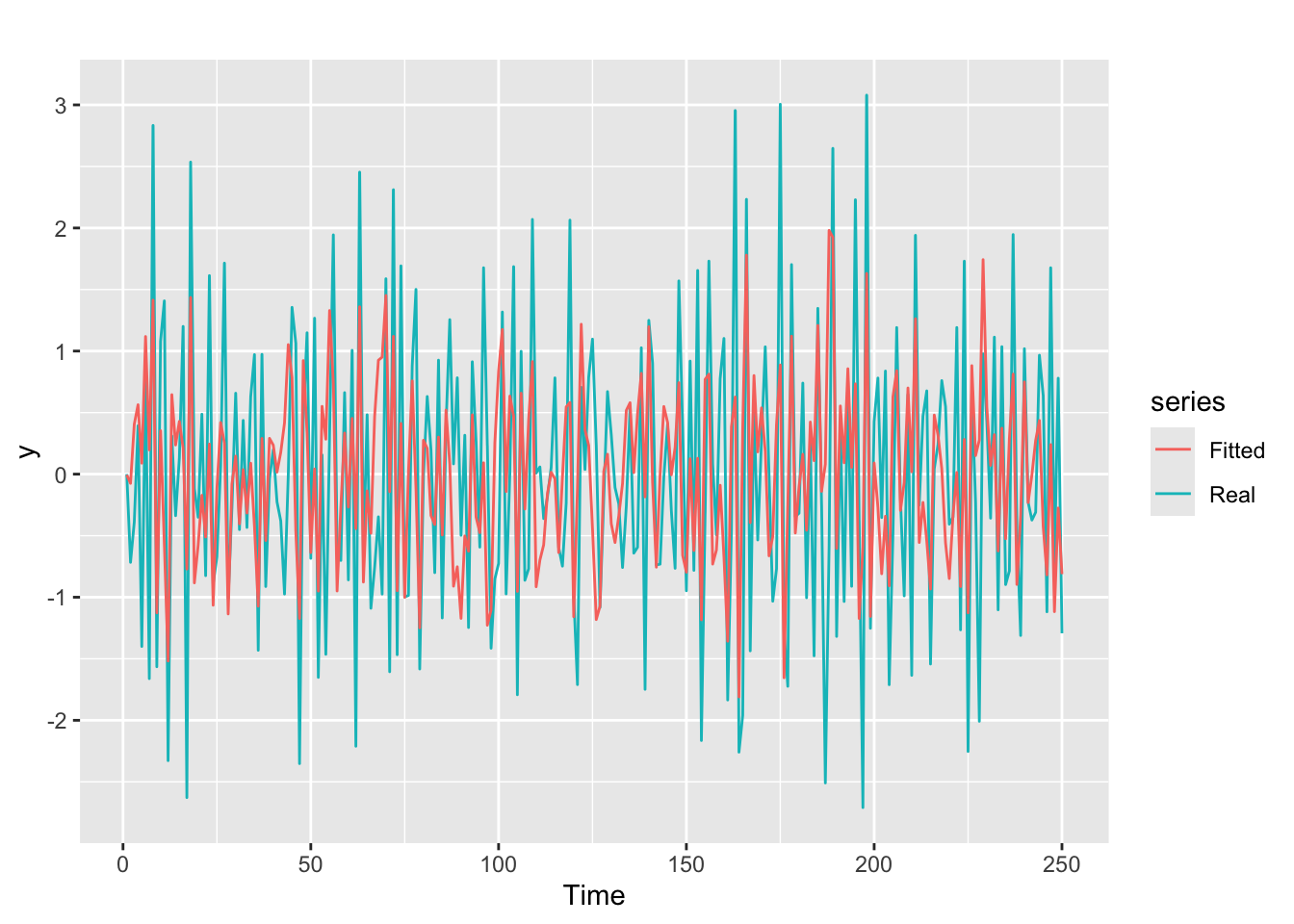

# Check fitted forecast

autoplot(y, series = "Real") +

forecast::autolayer(arima.fit$fitted, series = "Fitted")

# Line 53

## Simulate ARMA time series -------------------------------------------------------------------------------------------------------

sim_ts <- arima.sim(n = 250,

list(ar = c(0.8897, -0.4858), ma = c(-0.2279, 0.2488)),

sd = sqrt(0.1796))# Line 53

#Perform future forecast

y_est <- forecast::forecast(arima.fit, h=5)

autoplot(y_est)